The IRS has started accepting 2020 tax returns. June 4 2019 1254 PM.

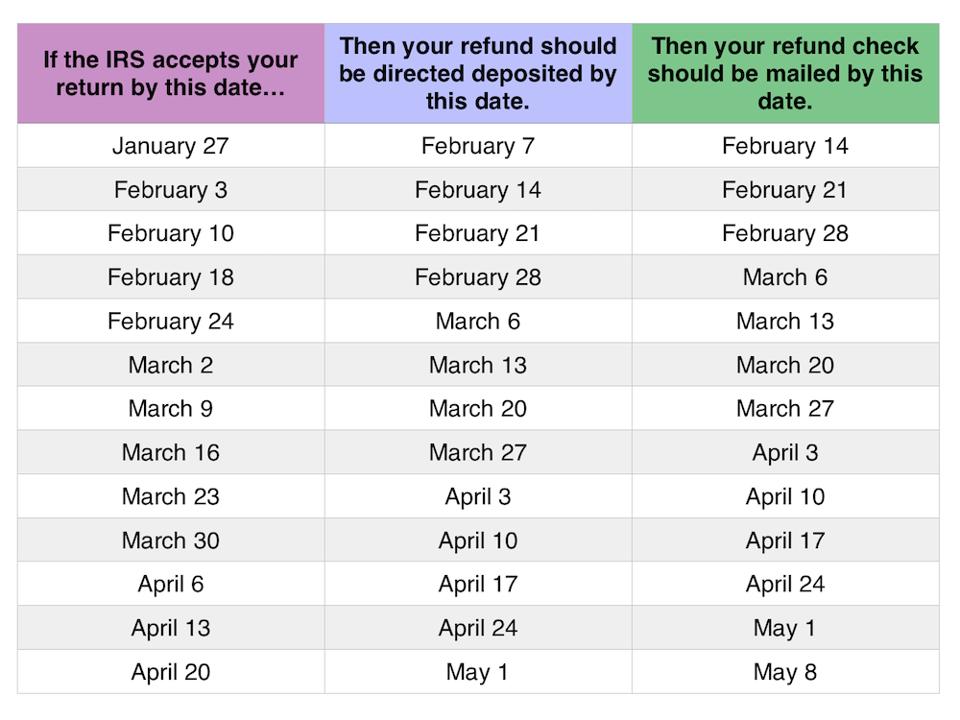

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

If the original Tax Year 2019 or Tax Year 2020 return was filed.

When does irs accept returns. Amended Returns for any other tax years or tax types must be filed by paper. It only means your return hasnt been rejected. Accepted means your tax return is now in the governments hands and has passed the initial inspection your verification info is correct dependents havent already been claimed by someone else etc.

As in past years the IRS will begin accepting and processing individual tax returns once the filing season begins. You can track returns online using the IRS Wheres My Refund tool. There must be a record of an original electronically filed return for Tax Year 2019 or Tax Year 2020.

The Internal Revenue Service has officially opened the 2020 tax filing season as of January 27 2020 as the agency begins accepting and processing federal tax returns for tax year 2019. The IRS recently confirmed it will begin processing tax returns on Monday January 27 2020. This isnt the end of the review process.

Amended Returns must be filed by paper for the following reasons. Since the COVID-19 pandemic may cause the IRS to process federal income tax returns a bit later than the usual its best to file taxes electronically if you want to get your tax refund faster. The IRS will begin accepting 2020 tax returns starting from February 12 2021.

The IRS will not start processing returns until January 28 except for small handful of returns that the IRS pulls early for testing purposes. Typically the IRS sends most refunds within three weeks of taxpayers filing their return. They will then hold the returns until the IRS begins accepting them.

WASHINGTON The Internal Revenue Service announced that the nations tax season will start on Friday February 12 2021 when the tax agency will begin accepting and. There is also a possibility where the 2021 tax season might get. For taxpayers who usually file their taxes early in the year and have all of the needed documentation there is no need to wait.

WASHINGTONThe Internal Revenue Service wont start accepting 2020 individual income tax returns until Feb. However many tax software programs will allow you to complete your return and file it before that date. FREE SHIPPING FOR ORDERS OVER 200.

The first official day to file your 2020 tax return is February 12 2021. The IRS is accepting 2020 tax returns starting February 12 2021. After acceptance the next step is for the government to approve your refund.

When the IRS accepts your return that means that it has passed an initial review and contains no obvious showstopping errors that the computer system would detect automatically. 13 Zeilen For 9 out of 10 taxpayers the IRS issued refunds in less than 21 days from the date the return. Hijabs for every women.

In normal years a return can be accepted in 24-48 hours once the IRS is processing sometimes less and occasionally longer. The PATH act was put in place to stop one type of tax fraud where tax thieves would file false tax returns claiming income from jobs that did not exist and claim EIC andor ATOC. If you file electronically you can start tracking your return within 24 hours of the IRS accepting it.

Next the IRS checks your numbers and math to ensure that everything matches up. The IRS says it will officially start accepting income tax returns on January 27 2020. What to know If you made 72K or less then you can file your federal taxes for free online DETROIT.

12 several weeks later than usual as. If you mail it in you have to wait four weeks. When does the IRS start accepting returns.

The Internal Revenue Service says taxpayers should expect limited face-to-face operations heavy call volume and paper-processing delays as it opens today for tax season 2021 accepting tax returns for tax year 2020. Only Tax Year 2019 and 2020 1040 and 1040-SR returns can be amended electronically at this time. The IRS doesnt send an acceptance notification for paper returns.

But this year is complicated by several issues including a backlog of 2019 paper tax returns that the IRS.