If youve lost an account dont feel bad. Retirement I worked for a small tech company for a little over a year and when I started a new job at a bigger company I wanted to roll it over as they had better investment options.

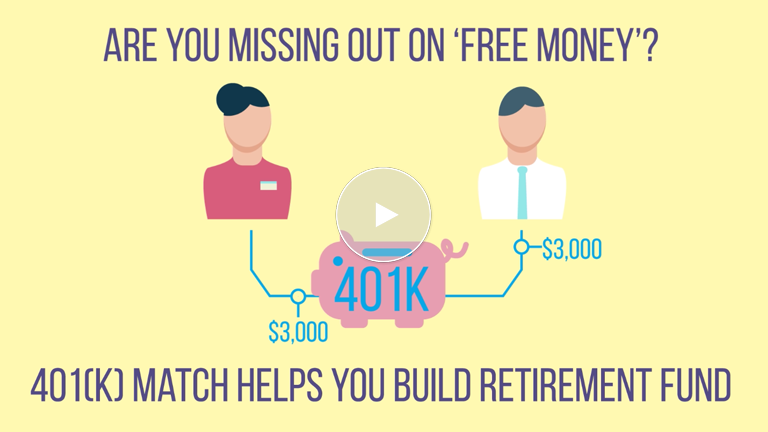

The Money Matters Series Are You Missing Out On Free Retirement Money At Work

The Money Matters Series Are You Missing Out On Free Retirement Money At Work

This is often the simplest choice.

401k missing money. You can perform a free secure database search to determine if you may be entitled to any unclaimed retirement or 401k funds that have been rolled over from a previous employer to an account at Millennium Trust. Here are five ways to locate information about an old 401k plan. ARE YOU MISSING MONEY.

401k Plans You can take a few steps to search for your unclaimed 401k retirement benefits. The unclaimed funds held by the state are often from bank accounts insurance policies or your state government. Ask them to check their plan records to see if you ever participated in their 401k plan.

2 days agoHow to Search for Unclaimed Retirement Benefits. The first thing you should do if your 401 k or IRA is losing money is to check that you are well diversified. The rules for IRAs and 401 k plans are different.

If your 401 k investment balance is more than 5000 most plans allow you to just leave it where it is. The first and best method of locating a 401k is to contact your old employers. If your 401 k lost value because of short-term market volatility and youre confident in your current asset allocation then you should simply ride it out.

Start your free search below by entering your social securitytax identification number. A common scenario for failure to claim 401k assets arises when former employees of closed or bankrupt companies are unable to locate their accounts because their employers failed to provide for the administration of 401k plan assets when they ceased operations. Start your search for unclaimed money with your states unclaimed property office.

Start your search-and-claim process here the only site endorsed by the National Association of Unclaimed Property Administrators. Search For Unclaimed Money in Your State. For assistance tracing these types of retirement accounts go to.

Businesses send money to state-run unclaimed property offices when they cant locate the owner. Its when that volatility becomes too much for you to stomach that you should go back to the drawing board and ask yourself how much risk youre really comfortable with. Department of Labor estimates each year tens of thousands of workers fail to claim or rollover 850 million in 401k retirement plan assets when they change jobs.

It is our intent to help match individuals with their unclaimed or missing money. My 401k rollover check has a lot of money missing. You want your money spread among.

First if you did put money into a 401k your money is protected by federal laws. The National Registry is a nationwide secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans. Powered by PenChecks Trust a leader in retirement plan distributions our website provides a safe simple way for.

Unclaimed 401k Search or Missing IRA Search. A disproportionate share of the missing are family members of deceased employees who fail to claim pension benefits stemming from employment that may have ended years earlier. If you have reason to believe you are entitled to an unclaimed pension either as the employee or spouse but have had no contact with the company and have not received payment complete the form below to initiate a search.

It costs nothing to search its FREE. If you dont urgently need the money leaving your 401. The first step is.

Americans lost track of more than 77 billion in retirement savings in 2015 according to the National Association of Unclaimed Property Administrators. To find it youre going to have to do some detective work. Americans lost track of more than 77 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401 k.

/32472099753_4ff632c47a_o-b4c2e90712494b0bb08b27cc9652ce30.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)