You should make sure that any refinance delivers the benefit you expect. But experts say that this mortgage maxim is actually a.

Is It Worth Refinancing For 0 5 Percent Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Is It Worth Refinancing For 0 5 Percent Mortgage Rates Mortgage News And Strategy The Mortgage Reports

In general you should refinance if it will save you money and with current interest rates at historic lows theres a good chance it will Verify your eligibility for a historic low rate.

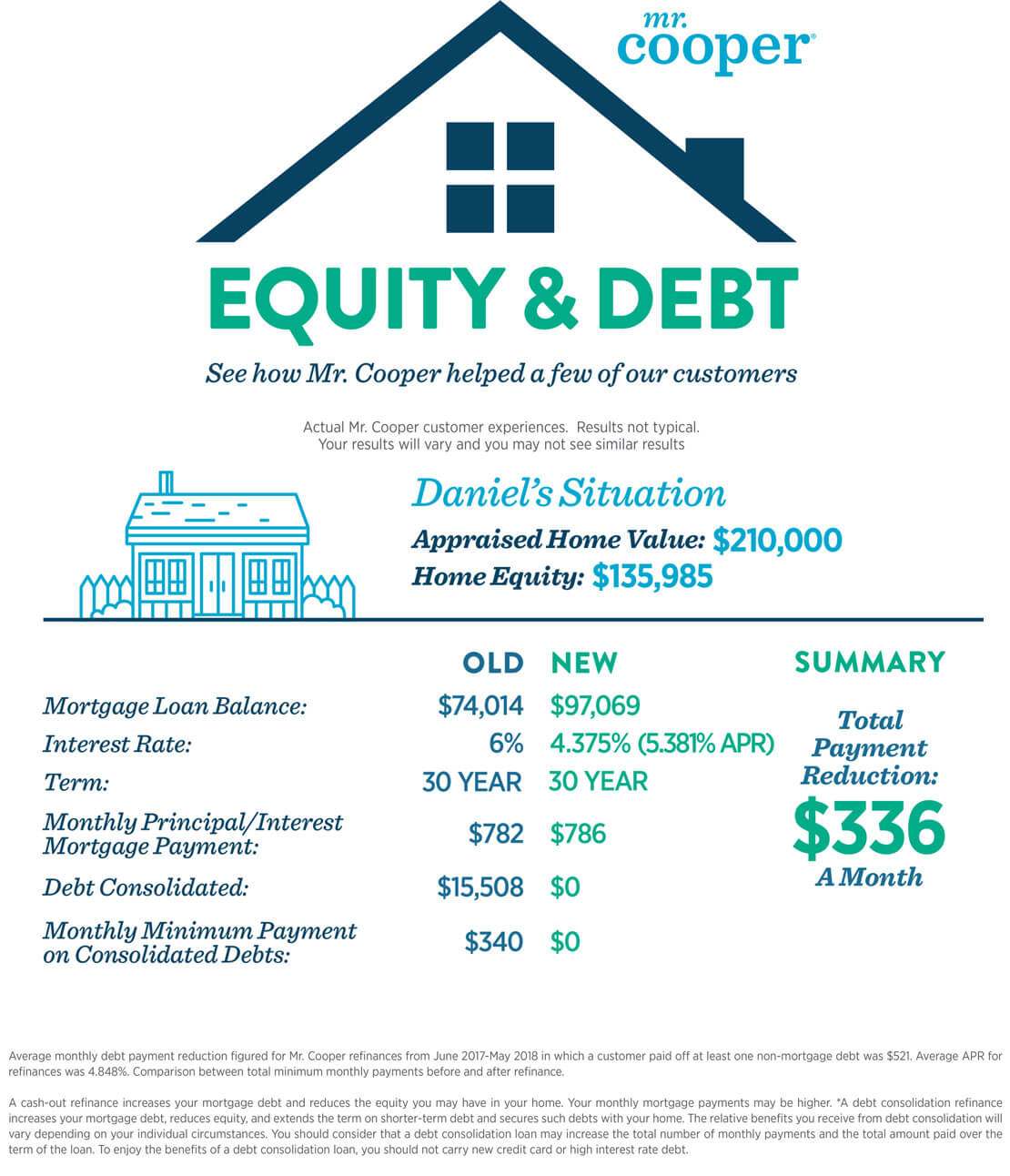

Should you refinance for 1 2 percent. Figure out how much it is going to cost to refinance your loan closing costs appraisal title services. Understand the full costs Unfortunately refinancing your mortgage isnt free. The fees involved in taking out a new loan can wind up costing you thousands of dollars usually 2 percent to as much.

For instance if youre four years into a 30-year mortgage and refinance to a new 30-year term it will have taken you 34 years total to pay off your home in the end. Most lenders allow you to roll the closing costs of the refinance into the balance of your new loan increasing the total amount borrowed. Refinance only if youre planning to stay in your home for a long time because it will give you time to make up those closing costs.

Your Second Mortgage Is More Than Half of Your Income. While the new guidelines only apply to qualified veterans seeking to refinance through the VA program theyre actually useful for all borrowers. You can refinance up to 1000000 with a cash-out max of 500000.

Gone through some difficult financial times since you got your first mortgage. The general refinancing rule of thumb is that lenders like you to have at least 20 equity in your home but there are exceptions. If you can find a loan that offers a drop of 12 in its interest rate you should think about it.

Historically the rule of thumb is that refinancing is a good idea if you can reduce your interest rate by. Remember to factor in your break-even analysis too. If you dont have that refinancing can be tough.

One of the best reasons to refinance is to lower the interest rate on your existing loan. The typical should-I-refinance-my-mortgage rule of thumb is that if you can reduce your current interest rate by 1 or more it might make sense because of the money you. If it is going to cost you very little it might be worth it.

Refinancing for a 1 percent lower rate is often worth it. Dont think you are avoiding these costs by financing them into your loan bala. One percent is a significant rate drop and will generate meaningful monthly savings in most cases.

Average refinance closing costs range between 2-6 of the loan amount. For example assume you pay 2000 in closing costs and fees for a new loan and your new payment will be 100 per month less than you pay now. This analysis allows you to figure out how long it takes to recoup the costs youll pay to refinance.

Refinancing usually requires you to have a certain amount of equity in your home. Refinancing your mortgage to lower your interest rate by a percentage point definitely will shrink your monthly payment. In this scenario it takes 20 months to break even to calculate take 2000 in costs divided by.

When mortgage interest rates drop more than a percentage or so some homeowners will decide to refinance their loans to get a better rate. These cash-out refinances also include jumbo loan refinances. The traditional rule of thumb says to refinance if your rate is 1 to 2 below your current rate.

Closing fees vary depending on your location loan type loan size and mortgage lender. For example dropping your rate 1. For example if you have a 51 ARM you could complete a refinance by the end of the fifth year and lock in a steady rate with a 30-year fixed-rate mortgage.

If you have specific questions about the accessibility of this site or need assistance with using this site contact us. Make sure to factor in your current loan term when considering refinance though. When Should You Refinance Your Home.

Consider that average interest rates on fixed-rate mortgages have ranged from less than 7 percent in the late 1990s to more than 15 percent in the early 1980s and you. Whether the reduction will be worth the hassle and the expense of refinancing however depends on your individual situation. The goal is for the borrower to come out ahead as a result of the refinance.

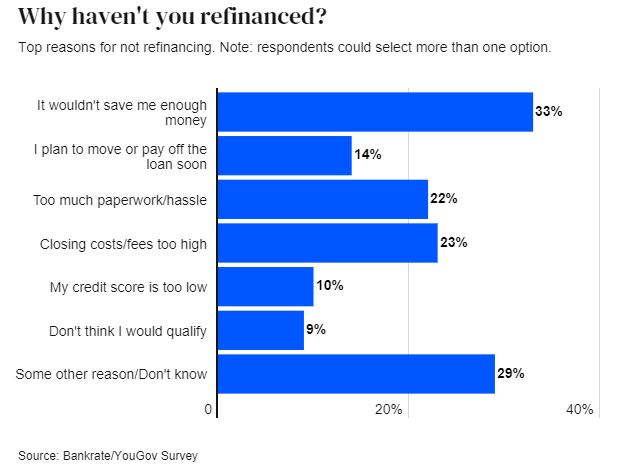

¹ For Figure Home Equity Line APRs can be as low as 249 for the most qualified applicants and will be higher for other applicants depending on credit profile and the state where the property is located. Associated Press file Its common knowledge that you should not refinance your mortgage unless the rate will fall by 2 percent.

.jpg)