Whats the difference between a regular monthly mortgage payment and a weeklybi-weekly payment Mortgages 14 replies We are selling our house. When you refinance you pay off the existing mortgage loan and replace it with a new one.

Fha Streamline Refinance Rates Requirements For 2021

Fha Streamline Refinance Rates Requirements For 2021

It is usually easier to refinance with the same lender.

Should i pay my mortgage if i am refinancing. A shorter loan term means youll pay less in total interest. If you plan to sell your home soon or if youve been paying your mortgage for more than half of the term be sure to use a loan refinance calculator. And if you were thinking of refinancing from your current mortgage term down to a 15-year fixed-rate mortgage the only one we recommend now is the prime time to do it.

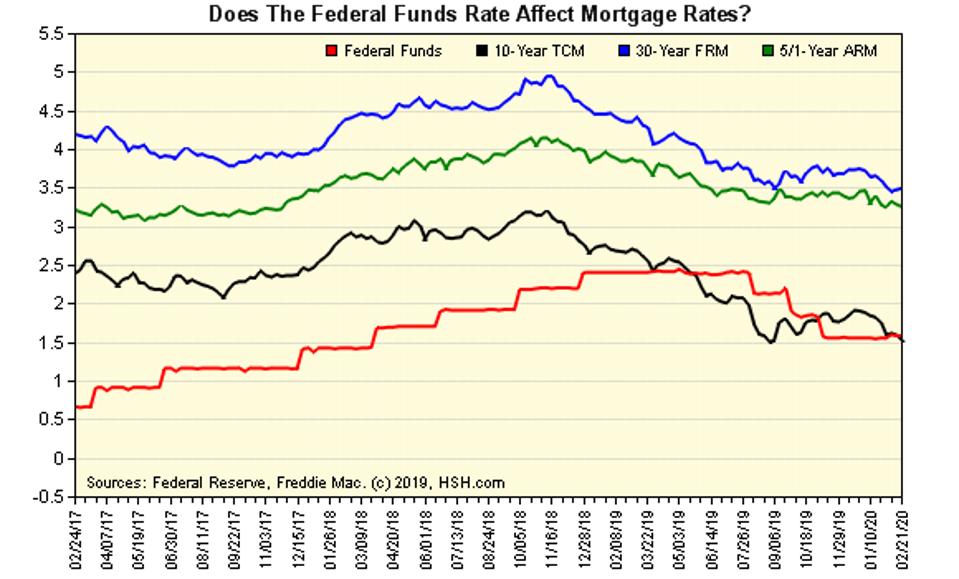

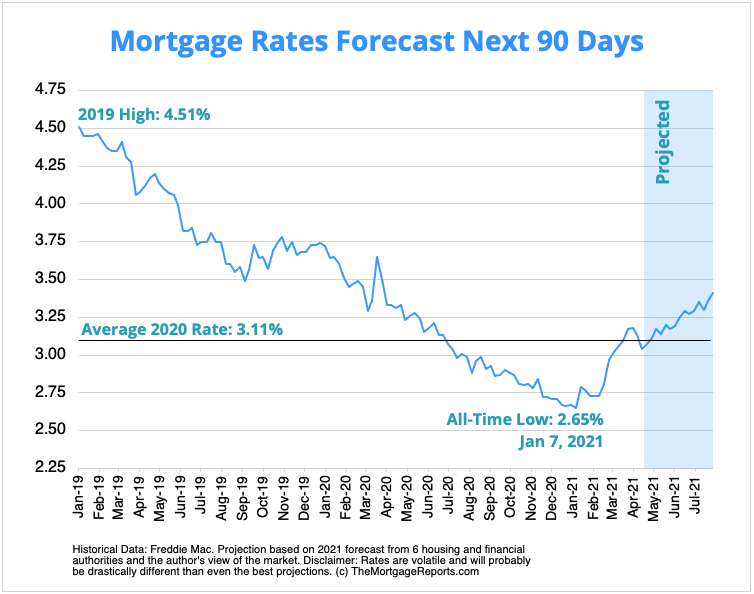

Refinancing into a lower interest rate may mean youll pay less over the life of your loan because a lower rate leads to less paid in interest. Lets say refinancing will save you 100 a month on the mortgage payment but will cost you 2000 in closing costs. Here are some illustrative numbers.

The closing date is scheduled for Jan 4th. Lower monthly payments can be achieved by reducing the interest rate or extending the loans lifetime. If youre keen to pay off debt you may want to refinance your mortgage to a shorter loan term.

In this case the borrower should pay off the mortgage because the 3 cost is less than the 325 rate on the mortgage after refinancing. However thats not the only potential benefit. Given that I see no reason to care about how fast I can pay my mortgage.

I am 6 years into a 30-year mortgage There is no way I will live long enough to see the end of my mortgage. 1 Some homeowners may find it more beneficial to take the opposite approach and refinance their mortgage into a shorter loan. Getting a mortgage with a 12 drop in interest rate can make a huge difference in your monthly budget and ability to pay off your mortgage faster.

You might pay several thousand dollars in closing costs when you refinance your home. Mortgage points are fees that you pay your mortgage lender upfront in order to reduce the interest rate on your loan and in turn your monthly payments. A single mortgage point equals 1 of your mortgage amount.

First refinancing could reduce your monthly mortgage payments which reduces the stress on your budget. According to the Federal Reserve It is not unusual to pay 3 percent to 6 percent of your outstanding principal in refinancing fees. The homeowner will be debt-free 100 months sooner by putting an.

They have your information they have a lot of the borrowers history payment history income etc on file Kan said. Do I pay my Jan mortgage payment Long Island 5 replies Fist mortgage payment v. Make this mistake and youll lose thousands when refinancing your mortgage.

In many cases youll see a smaller monthly payment if you refinance your mortgage to a lower interest rate and keep a 30-year mortgage term. First HOA payment Mortgages 2 replies. The breakeven period is how long it will take you to pay off the costs of closing on a new mortgage and start realizing the savings from a lower rate.

Those closing costs often can be rolled into the principal so you wont. The property securing the mortgage remains the same. The mortgage rate is 4 the assets used to fund loan repayment yield 3 and the borrower could refinance into a 325 mortgage that would be profitable over 10 years.

In reality while it may feel like youre keeping money in your pocket youre actually not. Just the interest rate and terms on the. Refinancing restarts your mortgage amortization schedule with the new loan reducing the amount of principal youre paying each month.

These expenses are in addition to any prepayment penalties or other costs for paying off any mortgages you might have. If it seems too good to be true thats because it probably is. 1 2013 1034 AM UTC.

I am always overly. When you are in the process of refinancing your mortgage you may come across refinance advertisements offering the chance to skip a mortgage payment for one month. We estimate closing costs at about 2 of the loan amount but if costs for your situation are higher plug in in the dollar figure and well tell you the interest rate.

If you have the cash for closing costs but cant qualify for a refinance use those funds to PreFi your mortgage by sending in a little extra each month or even all at once. You could add to your savings if you can secure a lower interest rate and shorten your term. So if you take out a 200000 mortgage a point is equal to 2000.

My call was unusual. Dont refinance and pay the mortgage more aggressively.