The company started out buying distressed mortgages for pennies on the dollar hence the name about five years ago and later moved on to the loan origination game. They only react to issues after they arise which I feel will ultimately be the downfall of the company.

Pennymac Loan Services Llc Mortgage Reviews

Pennymac Loan Services Llc Mortgage Reviews

Our research shows that stocks rated Zacks Rank 1 Strong Buy and 2 Buy.

Is pennymac a good company. However some staid old practices are firmly entrenched. I again stayed in contact with PennyMac. PennyMac is a very dishonest company.

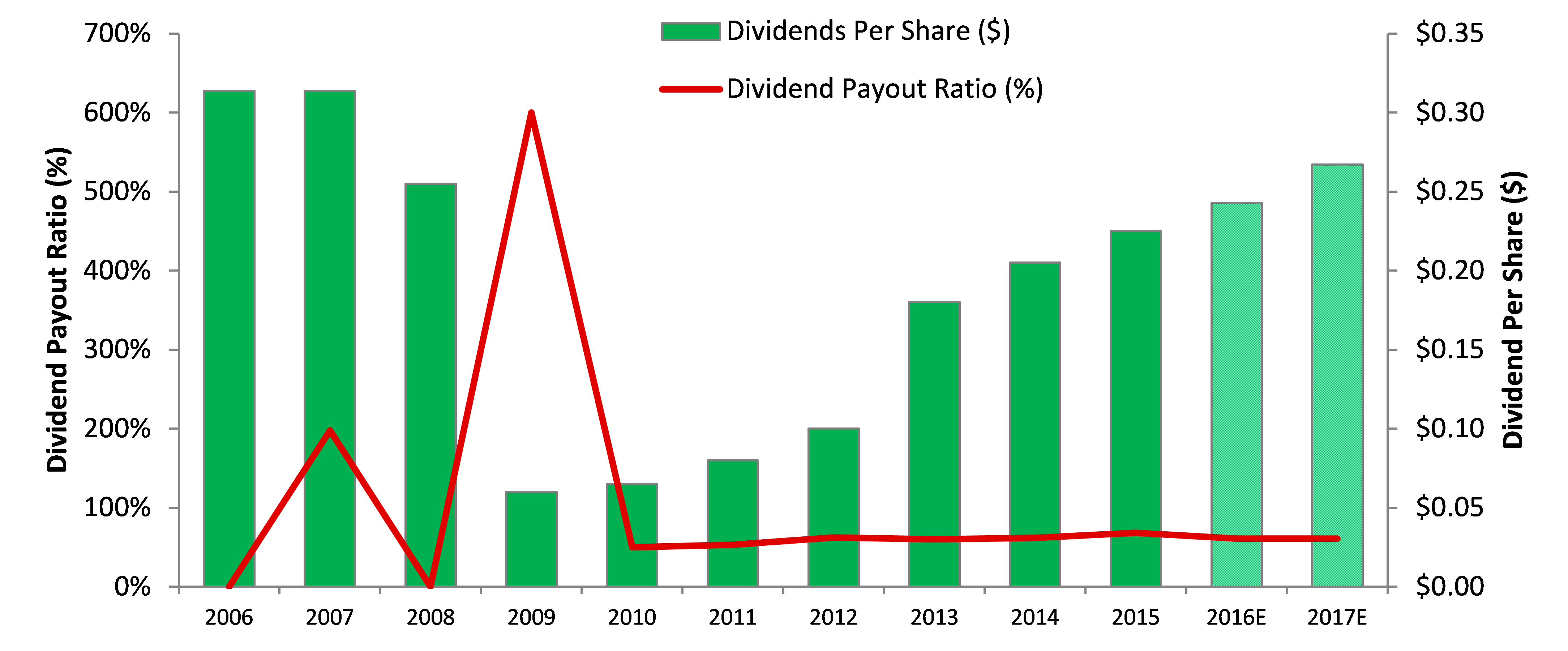

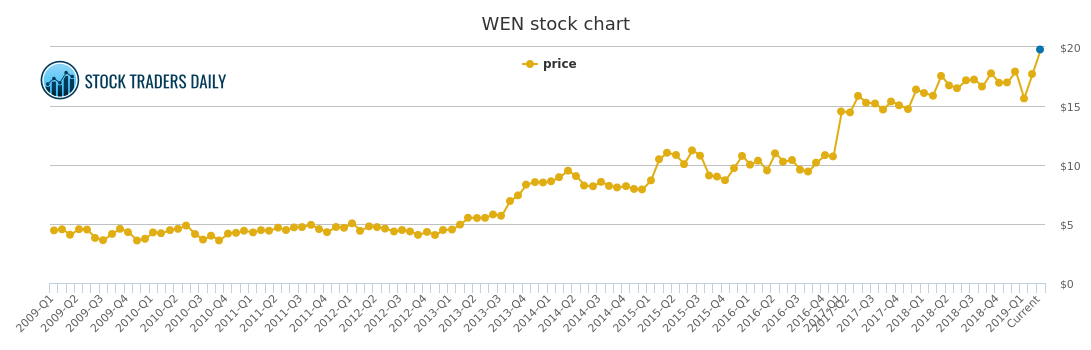

We believe that PennyMac Financial is a unique company in the US. Ive used the price-to-earnings ratio in this instance because theres not enough visibility to forecast its cash flows. The original unit that buys mortgages is known as PennyMac Mortgage Investment Trust and is currently publicly traded and doing quite well NYSEPMT.

Very little training and most of it is unstructured. PennyMac excels in online capabilities and makes it easy to shop rates online. PennyMac Financial Services is still a bargain right now according to my price multiple model which compares the companys price-to-earnings ratio to the industry average.

I called and was in close contact with someone at PennyMac. We have a diversified business model that includes complementary strategies that have generated strong and growing profits across a range of market environments. Unfortunately higher than normal turnover in lower positions.

However if you have a high LTV ratio youll only qualify for select loans. Ive been working at Penny Mac for the past year and although it is a good company to work for they are not a proactive company. PennyMac was the third largest mortgage lender the sixth largest mortgage servicer and largest aggregator of residential mortgage loans in the US.

Its a good place to get an entry level mortgage experience but there are little opportunities to move around. Average origination fees are higher than other lenders and home equity lines of. The bottom line.

PennyMac is a very dishonest company. Loan-to-value ratios at or below 80 are generally considered good but PennyMac allows ratios up to 97. If you ever struggle to make payments due to job loss divorce or illness you are screwed.

The company conducts its business through a consumer-direct model which relies on the Internet and call center-based staff to acquire and interact with customers across the country. Good working environment and the Pennypantry is awesome. Qualification requirements are in line with the rest of the industry and you can get a custom quote entirely online.

Niece I was back working I started making double payments to catch up. Nice growing company opportunity for growth. It is a very financially secure company and there are some changes coming it appears that will alter the environment.

They do not have a promotion or pay increase schedule. The stocks ratio of 423x is currently well-below the industry average of 117x meaning that it is. A lot of good hardworking people unable to do their jobs either because of micromanaging from upper management and or lack of training.

PennyMac Financial currently has a Zacks Rank of 1 Strong Buy. I lost my job after I held my mortgage for 25 years. PennyMac is one of the leading mortgage lenders in the nation and has a strong reputation with customers so its worth exploring if youre interested in refinancing your existing conventional FHA or VA loan.

PennyMac has been a terrific performer relative to its peers in the mREIT space as we can see aboveThe companys peer index has suffered immensely against the broader market in the past year. The company has posted a year-to-date return of 23 through June 17 which beats the SP 500 and the average return in. The bonuses are rigged.

Notable lack of women in upper management. One of them is PennyMac Financial Services a mortgage lender and servicer. It was also recently announced that PennyMac will IPO its PennyMac.