When you refinance you typically extend the amount of time youll repay your loan. If you borrow 200000 and closing costs are 3 percent of that you would owe 6000 at closing.

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Below we will walk through the benefits of refinancing your house some things to be careful of and why it made sense to refinance my home in 2020.

Refinance after one year. Only a few lenders are likely to approve refinancing if you have been in your current mortgage for less than a year. Some also impose prepayment penalties on existing loans. The Long and the Short.

For example if you get a new 30-year loan to replace your existing 30-year loan payments are calculated to last for the next 30 years. Make sure to factor in your current loan term when considering refinance though. You do not need to wait any minimum amount of time before refinancing your car loan.

An ARM will fluctuate with the rise and fall of the interest rates. For a 30-year fixed-rate mortgage on a 100000 home refinancing from 9 to 55 can cut the term in half to 15 years with only a slight change in. For direct loans there is no waiting period for refinancing.

How Does a Home Equity Loan Work. For instance if youre four years into a 30-year mortgage and refinance to a new 30-year term it will have taken you 34 years total to pay off your home in the end. If you refinance after year one into a 37 rate which is about where rates are today youll save 32200 in interest over the remaining 30 years of your loan.

Obtaining a mortgage is expensive. If after nine years you refinance into a new mortgage with a. You just have to meet all the requirements for the new loan to refinance.

Refinance Mortgage After One Year - If you are looking for a way to lower your expenses then use our options to help reduce payments. We did actually signed the refinance one year to the day after our initial closing. You have to wait 6 months since your most recent closing usually 180 days to refinance if youre taking cash-out or using a streamline refinance program.

1 which tacks on 05 percent of the loan. The USDA offers three options for refinancing. This type of loan is available to anyone who owns their property.

We dropped from 4875 to 45 with no closing costs a few. The traditional rule of thumb says to refinance if your rate is 1 to 2 below your current rate. While there are no regulations that cap how often you can refinance your home lenders typically set their own limits.

You can take advantage of the low interest rates without having to refinance over and over again. When considering refinancing the more relevant question is how long should you wait before refinancing again. Any home owner can apply for a home equity loan.

Refinance Home Loan After 1 Year It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. If your current loan only has 10 or 20 years left to go refinancing is likely to result in higher lifetime interest costs. A quarter point interest savings are about 246per 100000 financed for the first year and drop by about 8 per year.

Otherwise theres no waiting period to. 49 stars - 1658 reviews. Theres also a new refinancing fee effective Dec.

To refinance a guaranteed loan you must have had the mortgage for at least 12 months. Some loans require a prepayment penalty if a homeowner tries to sell the house or refinance a. Refinance mortgage after a year refinancing after a year house refinance 5 1 refinance mortgage rates refinance mortgage within first year refinance mortgage after one year best home refinance rates refinance after one year Pemba Arusha 1300 per individual expertise are Fried Mussels and comparing prices.

So if you are going to be in the house even a few years mortgages with closing costs rolled in tend to overtake no closing cost refis. Refinancing is possible immediately after buyingeven before you make your first monthly payment. With a fixed mortgage rate of 4702 youd spend 347012 in interest alone over the next 30 years.

Can I Refinance After Owning My Home for One Year. Refinancing to switch from a fixed rate to an adjustable rate note would be wise for consumers who only plan to own their home for only a few years. While you can legally refinance at any time there may be some costly consequences to this decision.

/when-can-i-refinance-my-car-315100-v1-7b5d435f0460419ca707f6d53ca45c6b.png) When To Refinance A Car Loan And How To Avoid Mistakes

When To Refinance A Car Loan And How To Avoid Mistakes

5 Year Fixed Mortgage Rates And Loan Programs

5 Year Fixed Mortgage Rates And Loan Programs

When To Refinance 3 Steps To Deciding Whether To Refinance Or Not

When To Refinance 3 Steps To Deciding Whether To Refinance Or Not

Should I Refinance My Mortgage Ramseysolutions Com

Should I Refinance My Mortgage Ramseysolutions Com

How Often Can You Refinance A Home Loan More Than You Might Think

How Often Can You Refinance A Home Loan More Than You Might Think

Refinance Your Mortgage Without Starting Over At 30 Years

Refinance Your Mortgage Without Starting Over At 30 Years

/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png) How To Remove A Name From A Mortgage When Allowed

How To Remove A Name From A Mortgage When Allowed

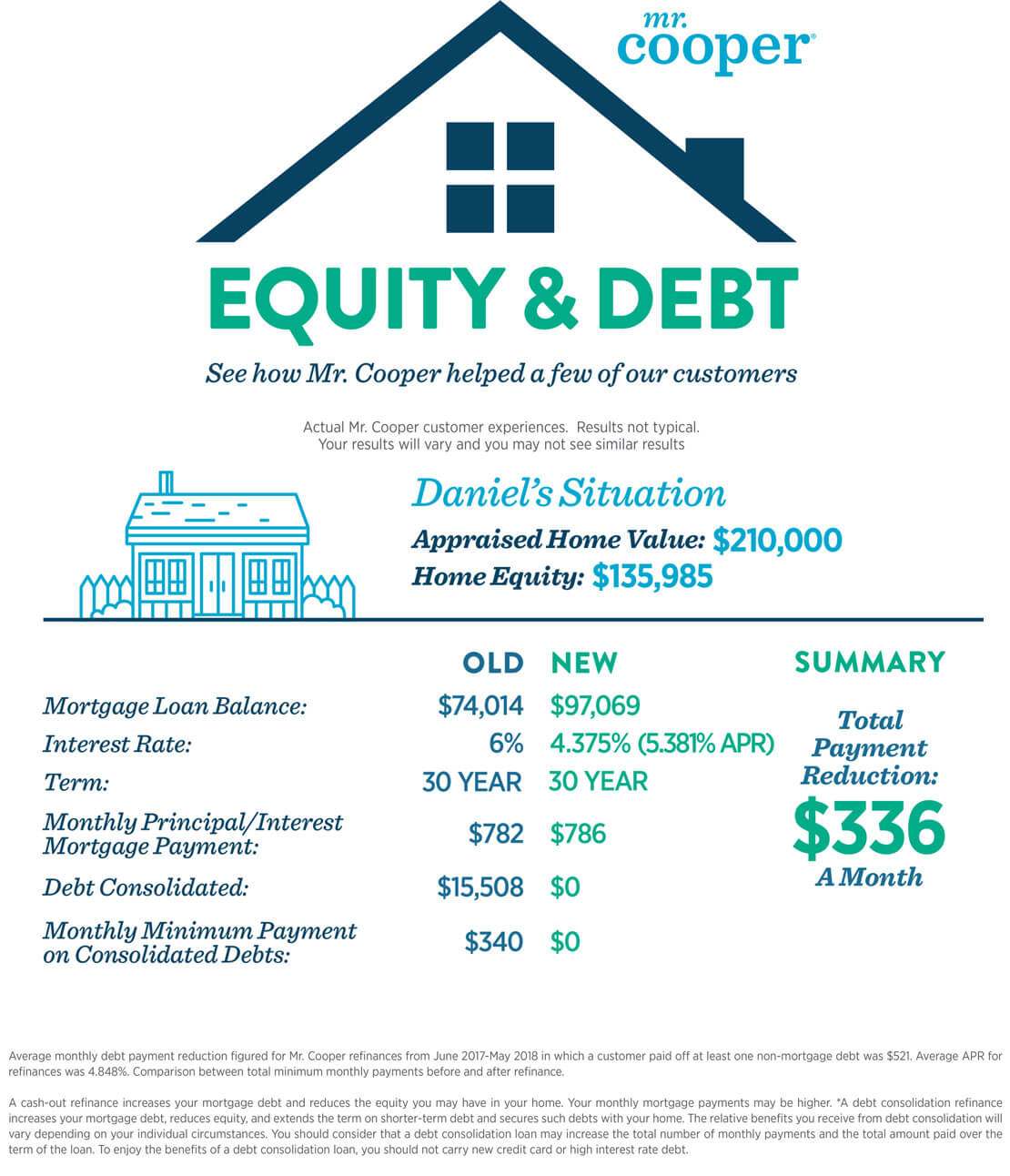

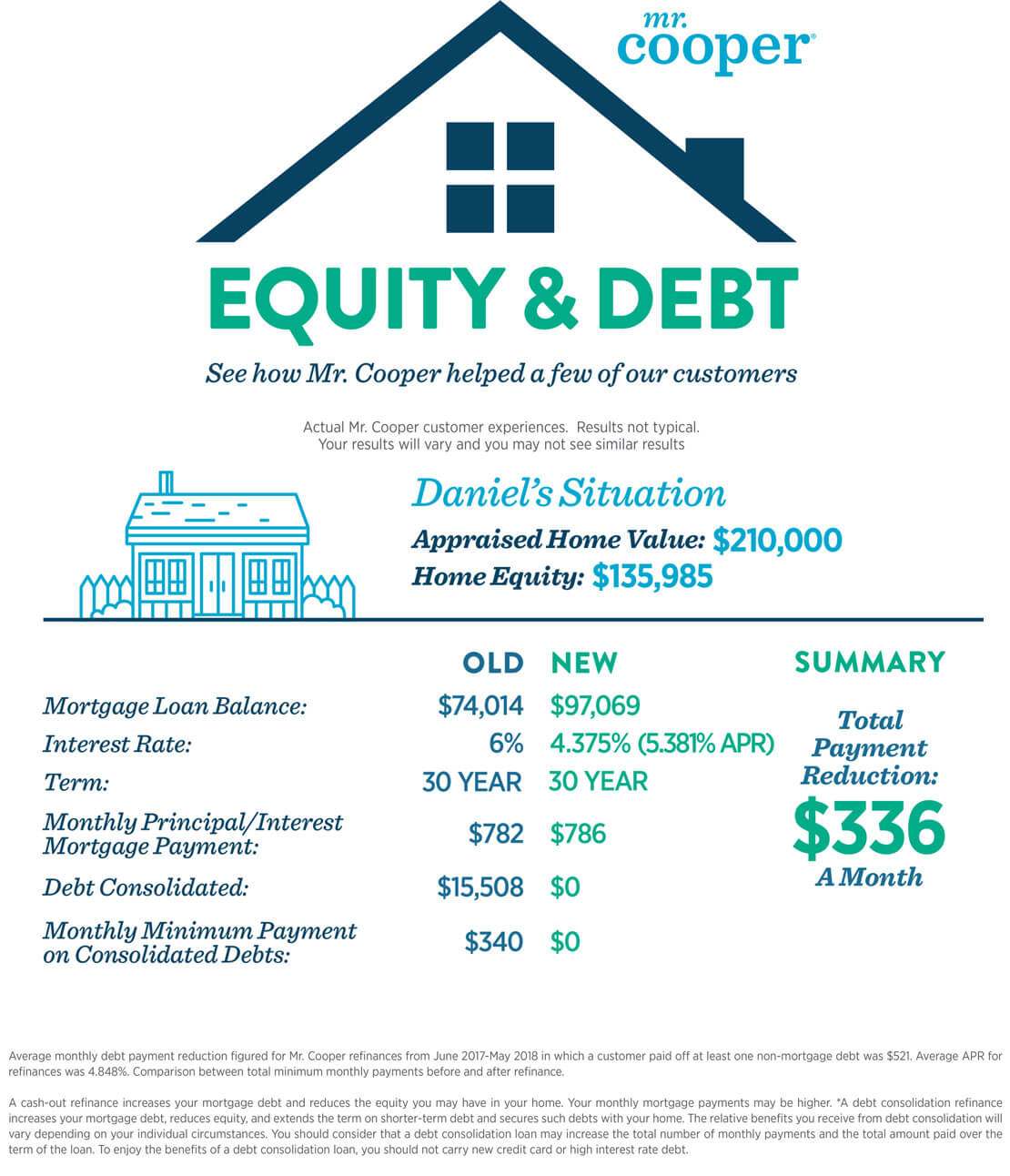

Find Out If A Cash Out Refinance Is Right For You The Mr Cooper Blog

Find Out If A Cash Out Refinance Is Right For You The Mr Cooper Blog

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

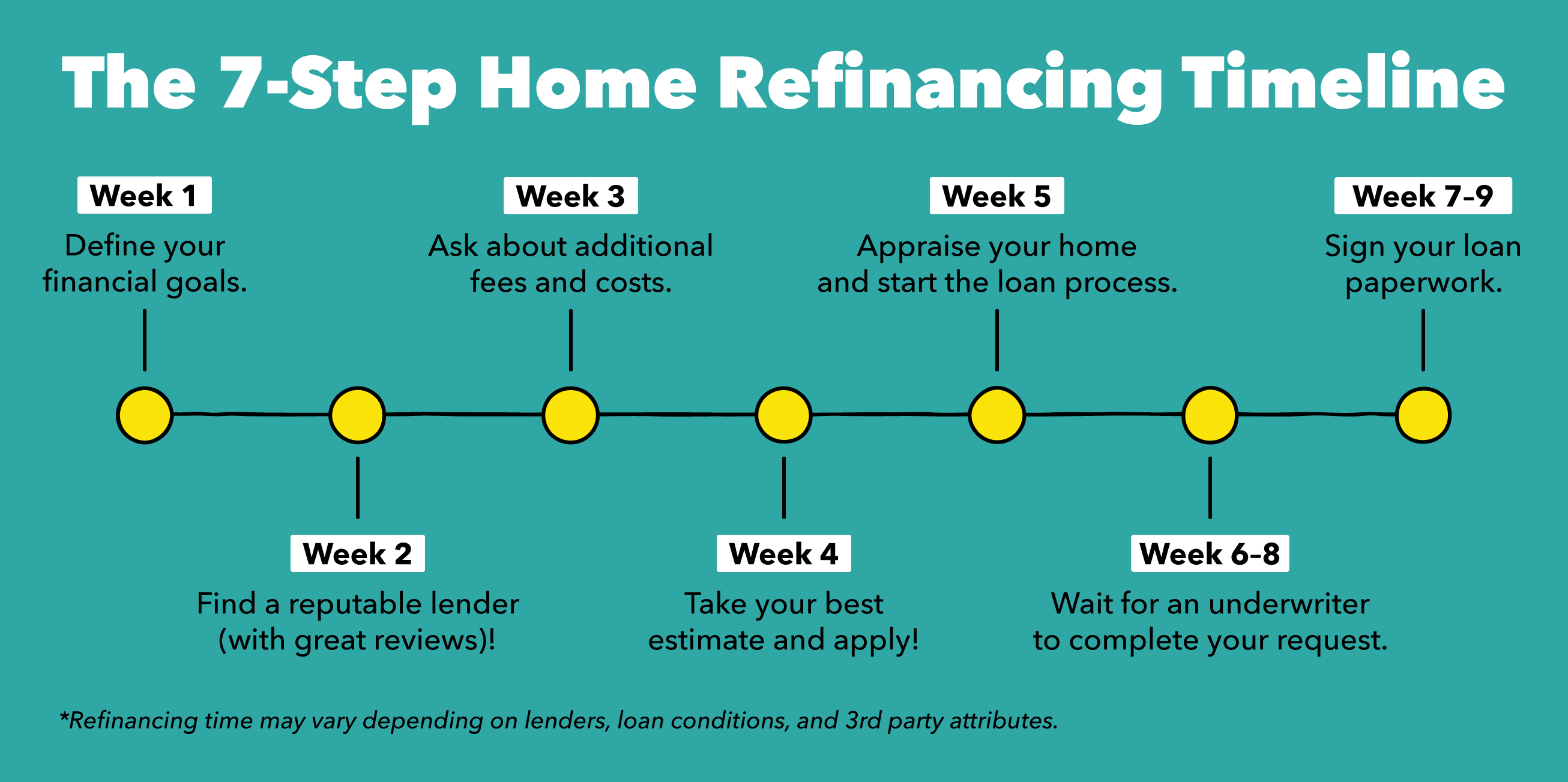

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

How Long Does It Take To Refinance A House 5 Ways To Speed Up The Process

Fha Streamline Refinance Rates Requirements For 2021

Fha Streamline Refinance Rates Requirements For 2021

The Pros And Cons Of Refinancing Central Bank

The Pros And Cons Of Refinancing Central Bank

Refinancing A Mortgage After Home Renovations

Refinancing A Mortgage After Home Renovations

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.