The child tax credit for 2021 is right now a temporary boost lasting only through the beginning of next year. The boost to the child tax credit will give eligible parents a total of 3600 for each child under 6 and 3000 for each child under age 18 for 2021.

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

4 rijen If you have a baby in 2021 your newborn will count toward the child tax credit payment of.

Tax child credit 2021. Zoek nu niet zoeken. Thats on top of payments for any other qualified child dependents you claim. After some procedural wrangling the Senate narrowly approved President Bidens stimulus package to.

In the tax year 2021 under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6. For 2021 only it is up to 1600 per child under 6 and 1000 per child under 18 at. Any changes to a 2022 child tax credit would need to.

Starting in July the IRS will begin sending out monthly payments of 250 or 300 through December to low- and. The new and significantly expanded child tax credit was included in the 19 trillion American Rescue Plan signed into law by President Joe Biden in. The American Rescue Plan Act which President Biden signed into law on March 11 temporarily increases the child tax credit from 2000 to.

For tax year 2021 families claiming the CTC for tax year 2021 will receive up to 3000 per qualifying child between the ages of 6 and 17 at the end of 2021. April 13 2021. The credit will be fully refundable.

The credit will also be fully refundable. They will receive 3600 per qualifying child under age 6 at the end of 2021. American families are set to receive a more generous child tax credit for 2021.

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600 if you and they qualify. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. On Saturday the Senate voted to pass the 19 trillion American Rescue Plan Act which includes provisions that increase the child tax credit to 3000 per child.

Advertentie Snelle en betrouwbare resultaten voor child tax credit 2021. Families would receive a monthly payment of 300 for each child under the age of 6 and 250 for each child age 6 to seventeen. Children who are adopted can also qualify if theyre US citizens.

Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child thats up to 7200 for twins. Advertentie Snelle en betrouwbare resultaten voor child tax credit 2021. The new credit for 2021 newborns will cap.

Until now the credit was up to only 2000. The child tax credit in 2021 has changed since last year most notably the increased payment amount. Taxpayers may receive part of their credit in 2021 before filing their 2021 tax return.

In the relief law passed in March 2021 Congress added an extra tax credit for many families with children. This would be instead of the lump sum refund that taxpayers claiming. An expanded child tax credit for 2021 is about to become law.

Zoek nu niet zoeken.

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

2021 Child Tax Credit Who Qualifies For Monthly Payments

2021 Child Tax Credit Who Qualifies For Monthly Payments

Donate To Arizona Tax Credit To Help Children Receive

Donate To Arizona Tax Credit To Help Children Receive

Child Tax Credit Expansion Here S How Much Money You Ll Get For Each Kid Cnet

Child Tax Credit Expansion Here S How Much Money You Ll Get For Each Kid Cnet

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

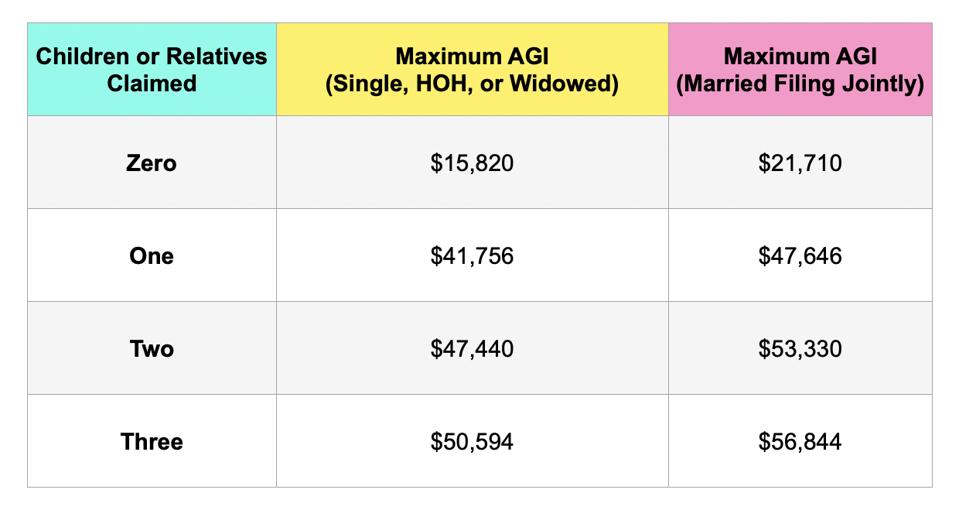

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Child Tax Credit Parents Of 2021 Babies Have One Extra Thing To Do To Claim Payments

Child Tax Credit Parents Of 2021 Babies Have One Extra Thing To Do To Claim Payments

Chart Explains What Your Family Will Get From The Stimulus Package

Chart Explains What Your Family Will Get From The Stimulus Package

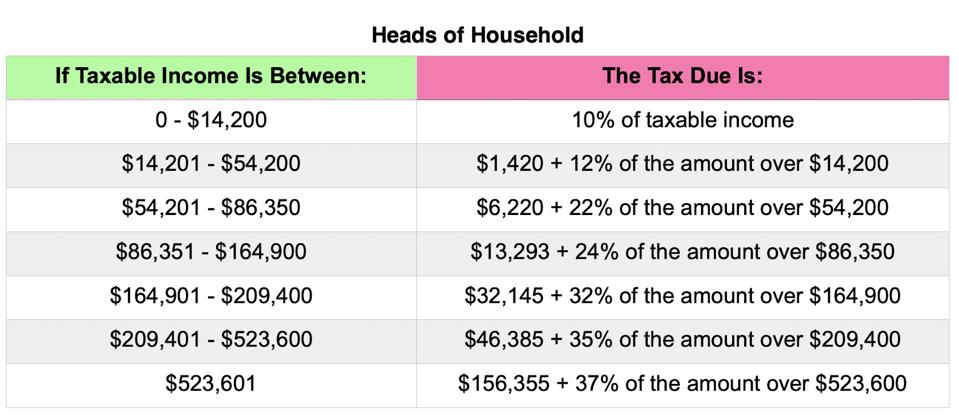

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.