These finances are then utilized to acquire assets which are mainly aimed at modernization such as commercial mortgages street-improvement utilities and so on. Includes business informationdebt schedule and owner history of business questionnaire.

Through the PPP businesses with up to 500 employees and some other companies can receive a loan for 25 times their monthly payroll costs up to 10 million.

Small business loan application. Applications are open until 31 December 2023. Then the loan application you fill out may vary depending on the type of small business loan you are trying to access. Who Can Apply for a Coronavirus Small Business Loan.

If you are a small business nonprofit organization of any size or a US. The loan can be forgiven if. Mudra loans can be availed from private and public sector banks commercial banks regional rural banks RRBs small finance banks and corporate banks.

All loan applicants should complete the Small Business Loan Application. ET SBA established a 14-day exclusive PPP loan application period for businesses and nonprofits with fewer than 20 employees. Small Business Administration loan programing and what SBA looks for in a loan application.

The same concept applies to obtaining a small business loan as your loan application history could affect your ability to get a new loan. Interested applicants can approach any of the above lending institutions or apply online through the official website of MUDRA. SMALL BUSINESS LOAN APPLICATION The following forms and financial information are required to process your Small Business Loan Application.

Your small business should be operated with a profit-seeking intention but should not be engaged in the investment of real estate. Receive a review of US. The agency doesnt lend money directly to small business owners.

This will take away any chance you ever had of getting a loan in the future. If your business or organisation is eligible and you submit an application through myIR you may be entitled to a loan. In some cases banks can even refer you to the police to get your name registered.

Bank or commercial small business loans Commercial real. Specifically on February 24 2021 at 900 am. States and territories are currently eligible to apply for a low-interest loan due to COVID-19.

This gave lenders and community partners more time to work with the smallest businesses to submit their applications while also ensuring that larger PPP-eligible businesses still had plenty of time to apply for and receive. Small business owners and qualified agricultural businesses in all US. Apply for a Start Up Loan for your business Apply for a government-backed Start Up Loan of 500 to 25000 to start or grow your business.

Businesses cannot apply independentlyfirst local county and state officials. If your loan has not been advanced because you were caught for your lies your application will be denied and your name will be blacklisted as a known fraudster. What Happens if I Get Caught Lying on a Small Business Loan Application.

Instead it sets guidelines for loans made by its partnering lenders community development organizations and micro-lending institutions. Small business owners can also apply for a government-backed Start Up Loan worth 500 to 25000 to help start or grow their business. The SBA works with lenders to provide loans to small businesses.

All forms must be typed or completed in ink and signed where required. Link is external Learn how to prepare to apply for a business loan what lenders look for and how they rate your loan application. Agricultural business with 500 or fewer employees that has suffered substantial economic injury as a result of the COVID-19 pandemic you can apply for the COVID-19 EI.

Agricultural businesses with 500 or fewer employees are now eligible as a result of new authority. 8 Zeilen Apply for a small business loan or line of credit online with US. SBA loans which include the standard SBA 7 a Loan 7 a Small Loan SBA Express Export Express Export Working.

An important qualification is that these businesses must be unable to secure alternative funding. Whether or not youve been approved for all of the loans youve applied for in the past your loan application history statement verifies any past applications for small business loans. This program is designed to help small businesses and small agricultural cooperatives who have suffered substantial economic loss due to the pandemic.

Eligibility for the Small Business Cashflow Scheme SBCS. This information helps lenders decide whether or not youd. We will administer the payments and repayments of this scheme.

The SBA helps small businesses get loans. The loan sanctioned under this program provides small businesses with fixed-rate financing. FSBDC at Hillsborough County.

Unlike a business loan this is an unsecured personal. This includes any individual trust estate or other business This includes any individual trust estate or other business entity requesting credit or the extension of credit as a borrower co-borrower or guarantor.

Jn Small Business Loan Application Form Vincegray2014

Jn Small Business Loan Application Form Vincegray2014

Small Business Loan Application Form Free Download

Small Business Loan Application Form Free Download

Small Business Loan Application Form Page 1 Line 17qq Com

Small Business Loan Application Form Page 1 Line 17qq Com

Personal Loan Application Form Template New Citibank Citi Instalment Loan Personal Loan Loan Loan Application Personal Loans Loan

Personal Loan Application Form Template New Citibank Citi Instalment Loan Personal Loan Loan Loan Application Personal Loans Loan

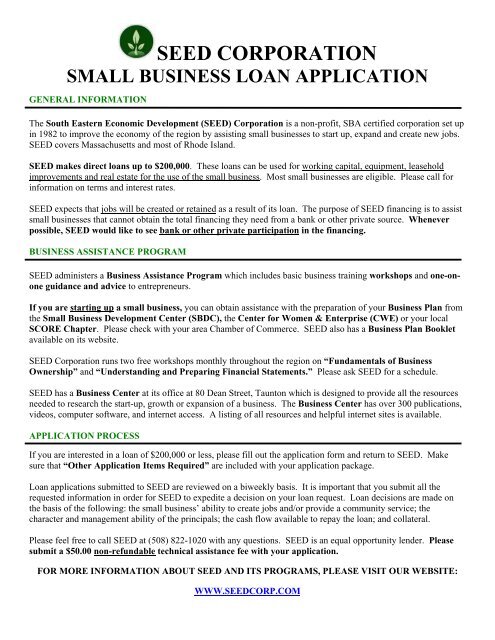

Seed Corporation Small Business Loan Application

Seed Corporation Small Business Loan Application

What To Know Before Applying For A Small Business Loan Cumberland Area Economic Development Corporation

What To Know Before Applying For A Small Business Loan Cumberland Area Economic Development Corporation

:max_bytes(150000):strip_icc()/smallbusinessloanapplication-ee992b6f9afb43b5a925dc176fcb85a9.jpg) Small Business Loan Application What Is It

Small Business Loan Application What Is It

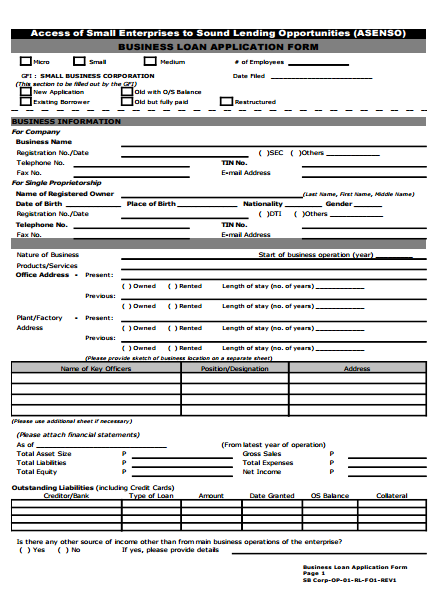

9 Business Loan Application Form Templates Pdf Free Premium Templates

9 Business Loan Application Form Templates Pdf Free Premium Templates

7 Disadvantages To Small Business Loans Complete Controller

7 Disadvantages To Small Business Loans Complete Controller

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

Ppp Small Business Loan Application Sba Downloadable Coronavirus Relief Form Cpa Practice Advisor

Small Business Loan Application Form Free Download

Small Business Loan Application Form Free Download

A Comprehensive Guide To A Small Business Loan Ondeck

A Comprehensive Guide To A Small Business Loan Ondeck

7 Types Of Small Business Loans Pros Cons

7 Types Of Small Business Loans Pros Cons

Clipboard With Small Business Loan Application Form And Pen On Desk Stock Photo Image Of Lending Bill 147982694

Clipboard With Small Business Loan Application Form And Pen On Desk Stock Photo Image Of Lending Bill 147982694

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.