A refund date will be provided when available indicate. A tax refund is money received back from a tax return.

Income Tax Refund Status Ay 2019 20 How To Check Online Basunivesh

Income Tax Refund Status Ay 2019 20 How To Check Online Basunivesh

This article aims to provide information on tax refunds in the Philippines why it happens how to compute it and how to avail.

Tax refund meaning. Tax Return vs Tax Refund. By recording charitable donations on their tax returns taxpayers can receive a further tax refund. This refund status is the second stage of the IRS refund updates and means you have nothing to worry about.

Wheres My Refund tells you to contact the IRS. One benefit of knowing how your tax return is prepared is knowing how much you already overpaid. It infers definitely what it says.

8 weeks when you file a paper return. Accepted means your tax return is now in the governments hands and has passed the initial inspection your verification info is correct dependents havent already been claimed by someone else etc. To give someone a refund.

Youre one step closer to getting that refund. Tax return and tax refund are two of the most commonly used terms in almost all tax systems. What does IRS tax message Your tax return is still being processed.

Tax returns allow taxpayers to. The additional payments will result in either a larger tax refund or a smaller tax bill at the end of the year. The taxpayers Form 1040 indicates the amount if any of tax refund that is due.

What Is a Tax Return. A tax refund is the difference between taxes paid and taxes owed. You may claim an income tax refund of the excess tax deducted or paid during the financial year while filing your tax return for that year.

A tax refund is whats issued to you by the US Treasury if in the previous year you paid more in state or federal taxes than you needed to. Last Updated on 05112020 by FilipiKnow. This assessment must be done by 31st July of each year as per the Income Tax Act where the fiscal year FY immediately succeeding a financial year is the required assessment year AY for that FY.

Government and is returned to a taxpayer. These timelines are only valid for returns we received on or before their due dates. Tax refunds are most common for employees from whose paychecks too much has been withheld because of deductions and credits for which the withholding does not account.

Definition of tax refund. You can use the IRS Tax Withholding Estimator. Updated for tax year 2018 A common nickname for tax season is refund season And that means tax filers like you are barraged with messages about getting your maximum refund Many of those messages come from tax software companies and even tax preparation storefronts.

Two objects The holiday was cancelled so the travel agency had to refund everybody the price of the. Money given back to a taxpayer if hesheit has paid too much in taxes for a given year. First they look for things like back taxes and unpaid child support.

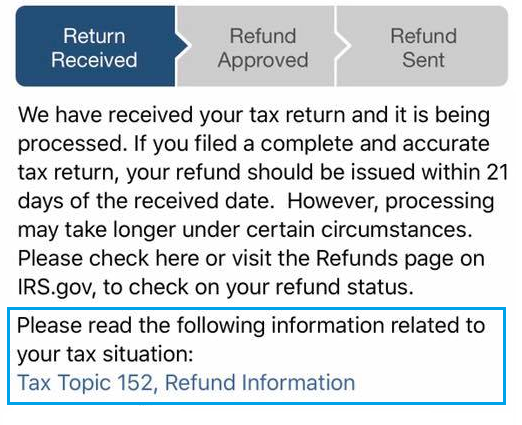

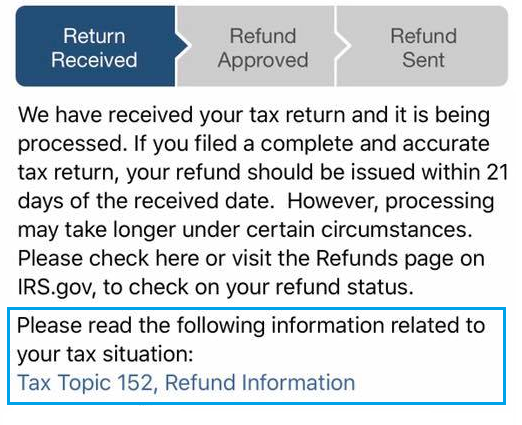

The taxpayer then submits the tax return electronically or. Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return. The IRS updates you with Your refund has been approved.

Tax is a financial charge imposed upon an individual or a legal entity by a state or a functional equivalent of a state such that failure to pay is punishable by law. Theyre setting up your return and when theyre set theyll post the date your rebate. By the principle of solutio indebiti meaning payment to one that is not due to him you are entitled to a tax refund.

2 weeks when you file online. 0 The amount of money that has been overpaid to the US. After the tax return is filed the Internal Revenue Services issues a check or an electronic payment to the taxpayer for the amount of overpayment.

After acceptance the next step is for the government to approve your refund. The Canada Revenue Agencys goal is to send your refund within. When I went on business to Peru the office refunded my expenses.

A return of money paid that is more than what is actually owed for taxes I cant wait to get my tax refund this year. A tax return is a form or forms filed with a tax authority that reports income expenses and other pertinent tax information. This means that your return was processed successfully and the estimated refund amount was approved by the IRS.

Each year or each quarter in some cases a taxpayer submits a tax return that calculates his or her federal income taxes owed. Do not file a second tax return.

Difference Between Tax Exemption Tax Deduction And Tax Rebate The Economic Times

Difference Between Tax Exemption Tax Deduction And Tax Rebate The Economic Times

This Map Shows The Average Tax Refund In Every State

This Map Shows The Average Tax Refund In Every State

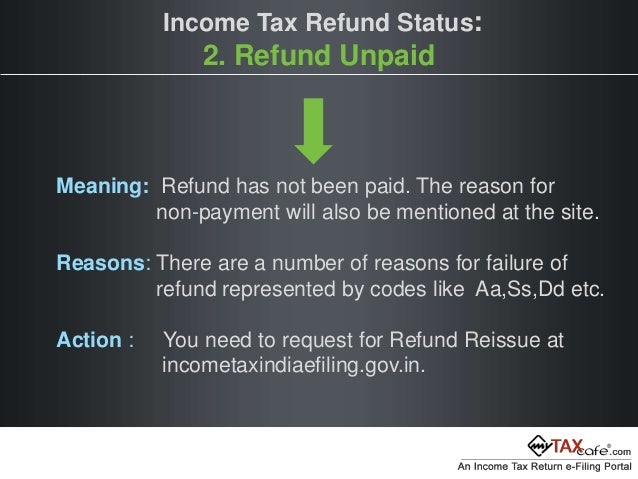

How To Check Income Tax Refund Status Mytaxcafe Help Guide

How To Check Income Tax Refund Status Mytaxcafe Help Guide

What Does Tax Topic 152 Mean Refundtalk Com

What Does Tax Topic 152 Mean Refundtalk Com

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png) Are Tax Refunds Taxable Unfortunately Yes Sometimes

Are Tax Refunds Taxable Unfortunately Yes Sometimes

How To Check Income Tax Refund Status Mytaxcafe Help Guide

How To Check Income Tax Refund Status Mytaxcafe Help Guide

Conceptual Hand Writing Showing Tax Refund Concept Meaning Refund On Tax When The Tax Liability Is Less Than The Tax Paid Man Standing Front Whiteboa Stock Photo Alamy

Conceptual Hand Writing Showing Tax Refund Concept Meaning Refund On Tax When The Tax Liability Is Less Than The Tax Paid Man Standing Front Whiteboa Stock Photo Alamy

Tax Refund Meaning Taxes Paid And Folders Stock Photo Picture And Royalty Free Image Image 29699481

Tax Refund Meaning Taxes Paid And Folders Stock Photo Picture And Royalty Free Image Image 29699481

Conceptual Hand Writing Showing Tax Refund Concept Meaning Refund Stock Photo Picture And Royalty Free Image Image 147852082

Conceptual Hand Writing Showing Tax Refund Concept Meaning Refund Stock Photo Picture And Royalty Free Image Image 147852082

What Is Tax Refund Interception What Does Tax Refund Interception Mean Youtube

What Is Tax Refund Interception What Does Tax Refund Interception Mean Youtube

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

The Pros And Cons Of Tax Refunds Don T Mess With Taxes

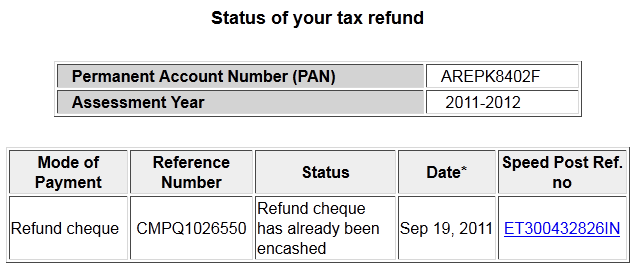

Income Tax Refund Status Online In India How To Check It

Income Tax Refund Status Online In India How To Check It

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.