High price 7394 low 7139. Oil prices will likely be stuck in the 65-70 range this summer Morgan Stanley says in a new note tempering its previous forecast for 70 oil with temporary overshoots because Will US.

Oil Price Forecast 2021 And Beyond Can Oil Become A Lucrative Investment Again

Oil Price Forecast 2021 And Beyond Can Oil Become A Lucrative Investment Again

The Oil Price forecast at the end of the month 7394 change for November 02.

What are oil prices going to do. 72 of retail lose money. At that point the Saudis increased production by 20 and flooded the world with oil. Yet there have been plenty of.

The average for the month 7294. The Oil Price forecast at the end of the month 7248 change for December -20. The WTI crude oil price has risen by 37 per cent since early November setting up strong support at 44-45 per barrel while there is resistance at the 50 per barrel psychological level and the February 2020 high of 5465 per barrel.

Annons Buy and Sell Oil CFDs With Our Software. In the beginning price at 7394 Dollars. The dramatic drop in oil prices in 2014 has been attributed to lower demand for oil in Europe and China coupled with a steady supply of oil from OPEC.

Oil Price forecast for December 2022. Oil production the diminished clout of OPEC and the strengthening dollar. High oil prices can drive job creation and investment as it becomes economically viable for oil companies to exploit higher-cost shale oil deposits.

But 2017 and 2018 have seen a growing economic boom and with it rising oil prices. Oils latest price moves and todays key news stories driving crudes action as well as developments in the broader energy sector. Now contracts for oil set to be delivered in June are coming up against that same deadline on May 19.

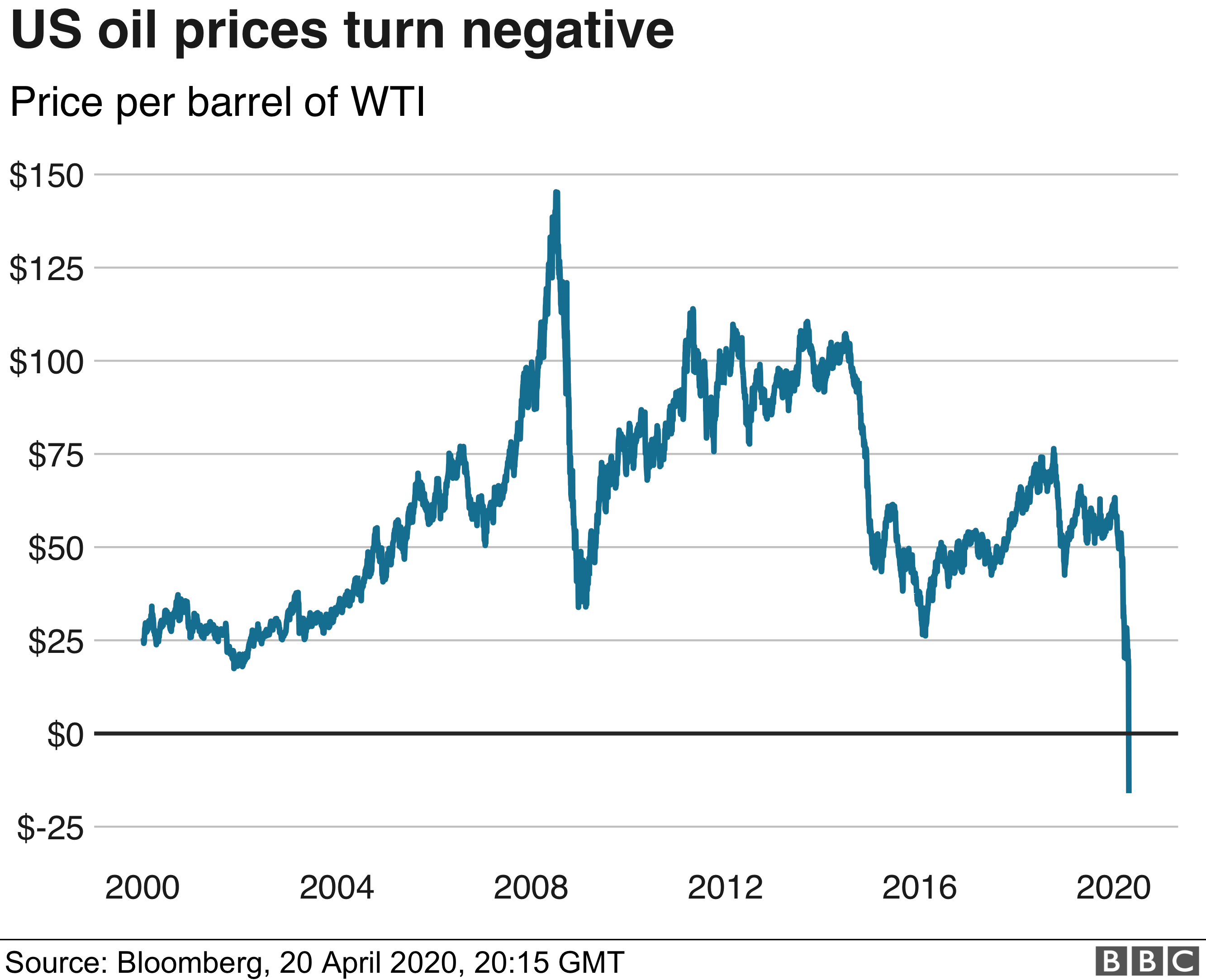

Oil prices are down more than 55 year-to-date having experienced the worst price plunges in nearly two decades in the face of record supply disappearing storage space. Politicians in a position where they feel they have to do something -- anything --. 72 of retail lose money.

The lag effect on oil prices could prove a positive for world economies helping to fuel a faster rebound after the virus subsides. Experts dont expect prices to dip below zero again but there are still a few things theyre. The oil market is in disarray a result of a coronavirus-led collapse in demand surplus supply following a price war and a shortage of storage.

However high oil prices also hit business and. US oil is trading at 3315 per barrel a decline of nearly 20. 4 The excess supply of oil caused oil.

The coronavirus pandemic has sent demand for oil plummeting. While not foreseeably as harmful as the 2008 crisis this potential recession will likely drop oil prices. Oil prices have become volatile thanks to unexpected swings in the factors affecting oil prices.

Annons Buy and Sell Oil CFDs With Our Software. Experts agree that rising crude oil rates indicate coming recession as oil price spikes preceded five out of the last six recessions in the US. There are already 300 million more barrels in storage than normal additional inventory that could delay an oil price rise by anywhere from four to six months once the economy picks up steam.

At 10 there would be more than 1100. In a 20 oil environment 533 US oil exploration and production companies will file for bankruptcy by the end of 2021 according to Rystad Energy. The average for the month 7390.

Todays prices are a result with even more production about to hit the market. The EIA expects in its November Short-Term Energy Outlook STEO that as global oil demand rises inventory draws in 2021 will cause some upward oil price pressures. If the price of oil stays in the 20s Ray Dalio estimated half of American exploration and production companies will go bankrupt by the end of 2016.

That has offset the three other factors affecting oil prices. Brent crude futures the global oil benchmark were down 22 last trading at 3545 per barrel. But even if non-OPEC oil production drops by 25 mbd by the end of the year which would probably require prices remaining below 30barrel that would only restore global production to pre.

Rising prices for crude oil and gasoline have alarmed many consumers and put President Bush and other US.

What Do Negative Crude Oil Prices Even Mean

What Do Negative Crude Oil Prices Even Mean

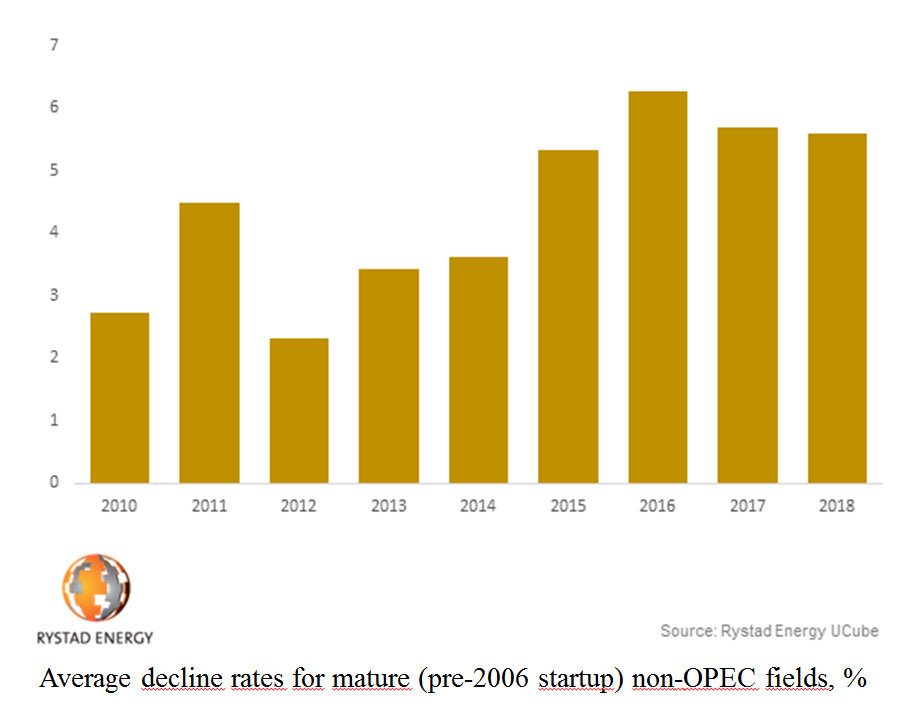

Why Oil Prices Are Going Up And Will Continue To Go Up

Why Oil Prices Are Going Up And Will Continue To Go Up

Wti Vs Brent Oil Prices When And Why Do They Diverge Laptrinhx

Wti Vs Brent Oil Prices When And Why Do They Diverge Laptrinhx

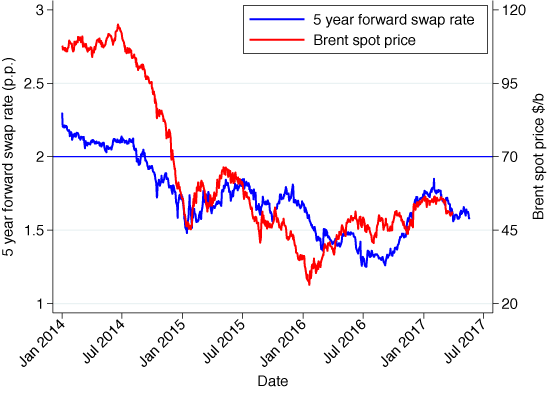

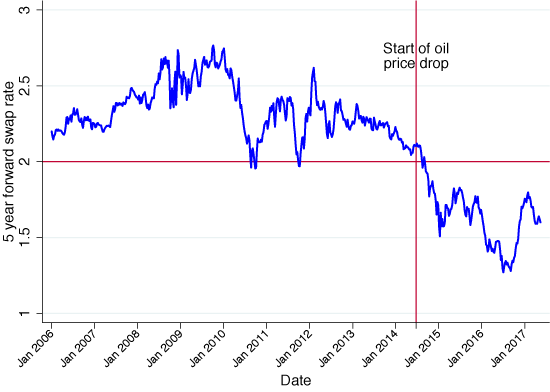

Oil Prices Do Not Affect Inflation Expectations After All Vox Cepr Policy Portal

Oil Prices Do Not Affect Inflation Expectations After All Vox Cepr Policy Portal

Will Oil Prices Rise In 2021 And Should You Invest In The Commodity Now

Will Oil Prices Rise In 2021 And Should You Invest In The Commodity Now

Short Term Energy Outlook U S Energy Information Administration Eia

Short Term Energy Outlook U S Energy Information Administration Eia

Oil Prices Do Not Affect Inflation Expectations After All Vox Cepr Policy Portal

Oil Prices Do Not Affect Inflation Expectations After All Vox Cepr Policy Portal

Us Oil Prices Turn Negative As Demand Dries Up Bbc News

Us Oil Prices Turn Negative As Demand Dries Up Bbc News

Oil Price Regimes Why Do Prices Stray From

Oil Price Regimes Why Do Prices Stray From

Do Oil Prices Still Correlate With Scrap And Steel Metal Bulletin Com

Do Oil Prices Still Correlate With Scrap And Steel Metal Bulletin Com

Landmark Opec Deal Can Do Little To Prop Up Oil Prices In The Near Term

Landmark Opec Deal Can Do Little To Prop Up Oil Prices In The Near Term

:max_bytes(150000):strip_icc()/why-are-gas-prices-so-high-3305653-Final-5c890fd9c9e77c0001f2ad51.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.