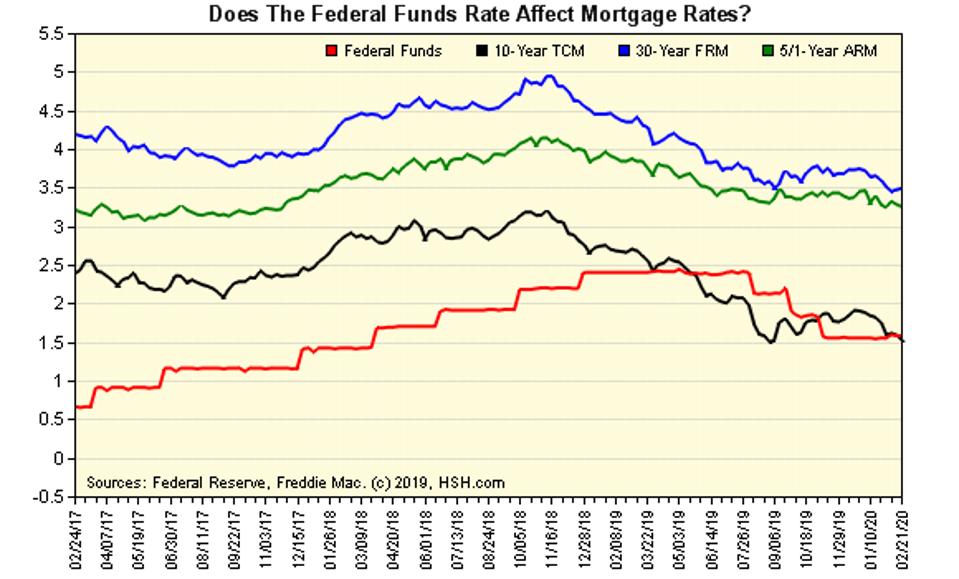

The average 51 adjustable-rate mortgage ARM refinance rate. Many Americans refinanced their mortgage with record low interest rates in 2020 but it really depends on your situation if refinance rates in 2021 will.

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

The average 15-year fixed mortgage refinance rate is 2460 with an APR of 2660.

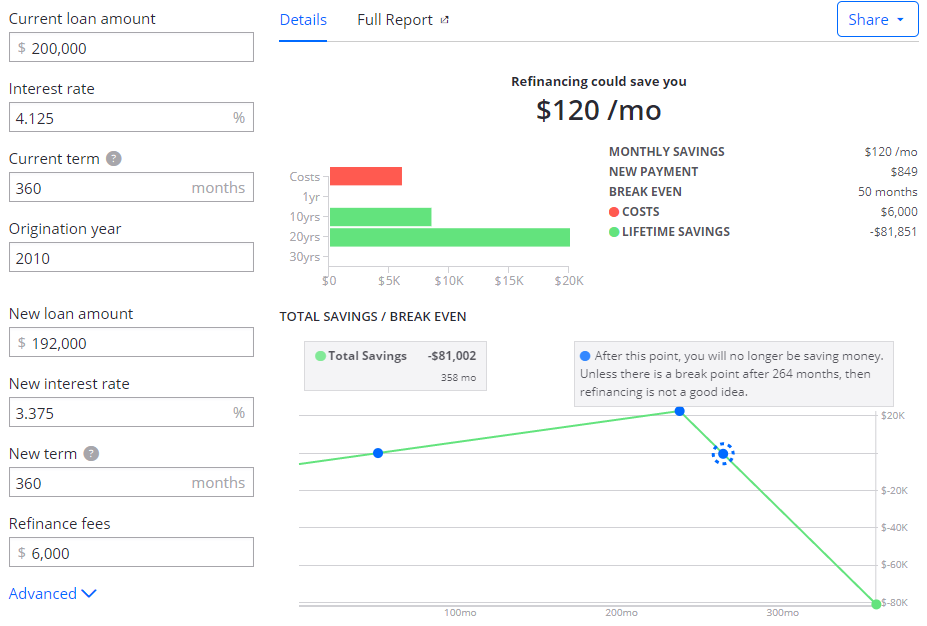

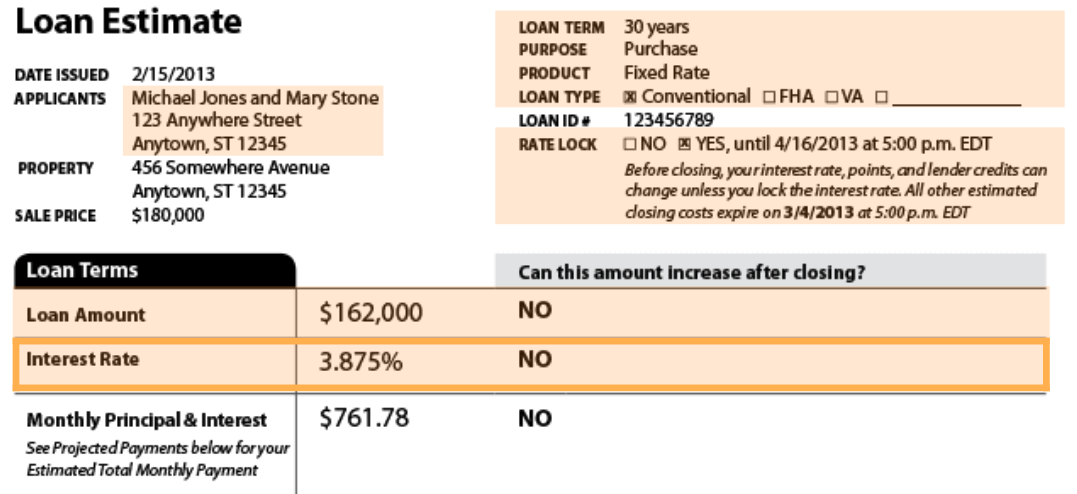

What is the interest rate for refinancing. There are plenty of reasons to consider refinancing. If however you waited until the rate was low enough that you saved 150 per month you would only need 20 months to break even that might make more sense. If you initially get a mortgage with a rate of 5 and learn you can refinance to a mortgage with a rate of 4 you might decide its worth the cost and trouble of refinancing to nab that lower rate.

It would take you 60 months to break-even on the loan. The adverse market refinance fee scheduled to go into effect Dec. The rate on 15-year fixed mortgages a year earlier was 424.

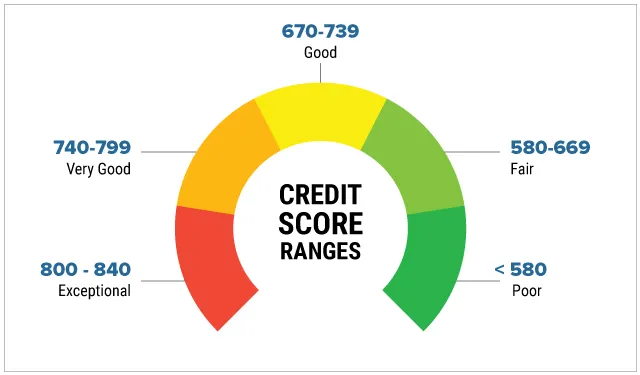

The current mortgage rates listed below assume a few basic things about you including you have very good credit a FICO credit score of 740 and that the home is your primary residenceCheck out the mortgage rates charts below to find 30-year and 15-year mortgage rates for each of the different mortgage loans US. If you keep the existing loan youll spend roughly 69565 in interest over the next 10 years. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance.

But getting a lower refinance mortgage rate is not the end goal in itself. Again keep in mind that refinancing costs 3 to 6 of the loans principal. 8 rader Interest rate APR.

In that case refinancing looks more attractive. If you refinance youll spend about 58545 in interest over the next 10 years. For many borrowers now October 2019 is a very good time to consider refinancing.

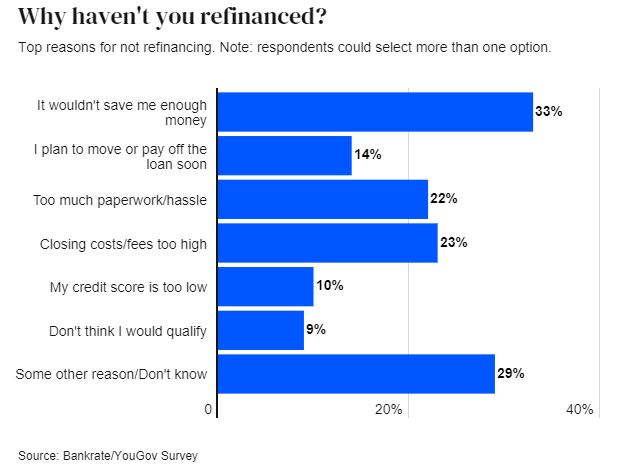

The main refinancing operations rate is one of the three interest rates the ECB sets every six weeks as part of its work to keep prices stable in the euro. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for a 5y6m ARM 7 years for a 7y6m ARM. When you refinance a mortgage you simply replace the existing loan with a new one for the same amount usually at a lower interest rate or for a shorter loan term or both.

When they do this they have to provide collateral to guarantee that the money will be paid back. 12 rader On Thursday April 29 2021 the benchmark 30-year fixed refinance rate is 3160 with an APR of. Refinance rates valid as of 26 Apr 2021 1004 am.

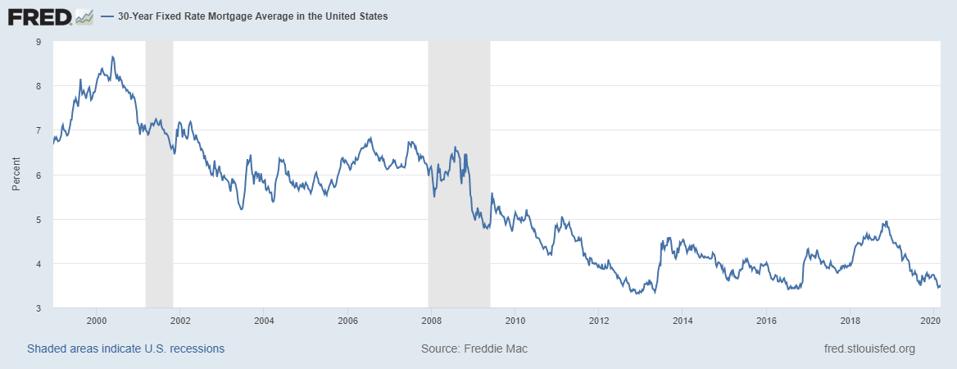

In comparison the average rate on 30-year fixed mortgages for the same period in 2018 was 481. How to read our rates. So if you are.

In many cases its to pay a lower interest rate on their home loan. Saving money is the obvious one. Freddie Mac reports that for the week of November 15 2018 the typical 30-yer mortgage was priced at 494.

Real life numbers. It takes years to recoup that cost with the savings generated by a lower interest rate or a shorter term. 1 2020 is 05 of the loan amount and applies to most conventional mortgage refinance transactions.

The reason is that interest rates have fallen significantly during the past year or so. For 15-year fixed-rate mortgages the rate for November 21 2019 was 32 compared with the previous weeks figure of 315. EDT and assume borrower has excellent credit including a credit score of 740 or higher.

13 rader 30-Year Fixed Refinance Rate 3160. Lets say for sake of an example that you will pay 3000 in closing costs and the current interest rate will save you 50 per month. The current average 30-year fixed mortgage refinance rate climbed 5 basis points from 286 to 291 on Thursday Zillow announced.

The 30-year fixed mortgage refinance rate on April 29 2021 is up 13 basis points from the previous weeks average rate of 278. In August 2008 the average 30-year fixed-rate mortgage had an interest rate of 648. 15-Year Fixed Refinance Rate 2470.

The main refinancing operations MRO rate is the interest rate banks pay when they borrow money from the ECB for one week.

Refinance Trends In The First Quarter Of 2020 Freddie Mac

Mortgage Rates Just Spiked Is It A Good Time To Refinance Money

Mortgage Rates Just Spiked Is It A Good Time To Refinance Money

How Does Refinancing Work How And When To Refi Zillow

How Does Refinancing Work How And When To Refi Zillow

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages

Main Refinancing Operations Interest Rate 1 1999 2012 Download Scientific Diagram

Main Refinancing Operations Interest Rate 1 1999 2012 Download Scientific Diagram

Current Refinance Rates Compare Rates Today Bankrate

Current Refinance Rates Compare Rates Today Bankrate

How Often Can You Refinance Your Home Forbes Advisor

How Often Can You Refinance Your Home Forbes Advisor

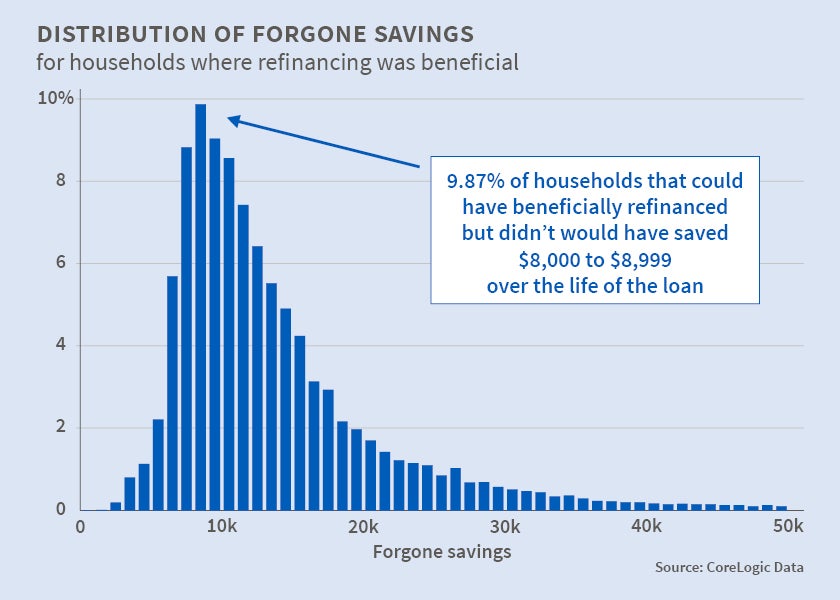

Borrowers Forgo Billions Through Failure To Refinance Mortgages Nber

Borrowers Forgo Billions Through Failure To Refinance Mortgages Nber

What Is Today S Interest Rate For Refinancing A Home

What Is Today S Interest Rate For Refinancing A Home

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

How To Shop For Refinance Rates And Compare Offers 7 Steps Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Shop For Refinance Rates And Compare Offers 7 Steps Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Refinancing In Response To Interest Rate Changes Source Reproduction Download Scientific Diagram

Refinancing In Response To Interest Rate Changes Source Reproduction Download Scientific Diagram

What Will These Mortgage Rates Do To Homeowners Trying To Refinance Homebuyers And Mortgage Lenders Wolf Street

What Will These Mortgage Rates Do To Homeowners Trying To Refinance Homebuyers And Mortgage Lenders Wolf Street

Rates Drop Under 4 Refinance Check 7 Million People Can Lower Mortgage Rate By 0 75 My Money Blog

Rates Drop Under 4 Refinance Check 7 Million People Can Lower Mortgage Rate By 0 75 My Money Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.