Social Security and Medicare eligibility. Reverse mortgage payments are considered loan proceeds and not income.

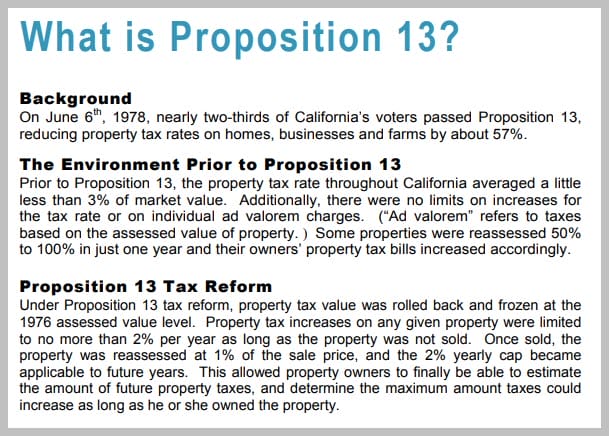

How Capital Gains And Proposition 13 Affect Reverse Mortgages

How Capital Gains And Proposition 13 Affect Reverse Mortgages

Since reverse mortgage loan proceeds arent considered income they wont.

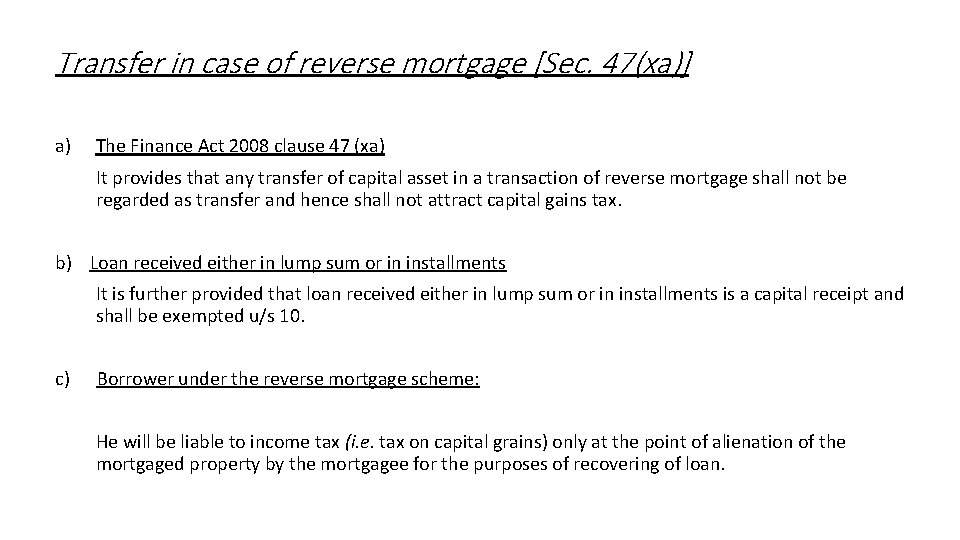

Reverse mortgage capital gains tax. Remember under the reverse mortgage heirs can choose to repay the loan at the amount owed or 95 of the current value whichever is less. 155 Consequent to these amendments a borrower under a reverse mortgage scheme will be liable to income tax in the nature of tax on capital gains only at the point of alienation of the mortgaged property by the mortgagee for the purposes of recovering the loan. Example of such a scheme is PNB BAGHBAN.

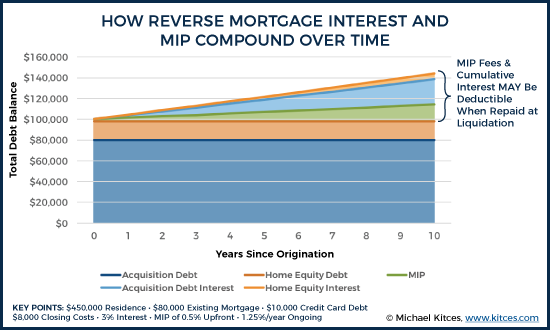

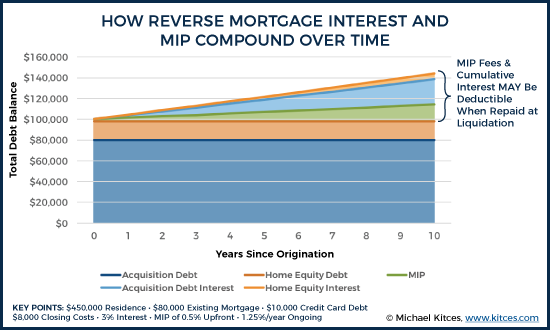

For those who use a reverse mortgage to generate the cash to make the payment for real estate taxes whether by drawing against the home equity line of credit using the lump sum proceeds of a cash-out reverse mortgage or paid via the ongoing tenure payments structure the favorable tax treatment of real estate taxes is the same. If the result is a negative number you have a capital loss of that amount. Whats important to remember here is that it takes substantial capital gains before you hit the threshold where the IRS is interested.

As far as taxes go there are pros and cons to reverse mortgages. Subtract the total amount you originally paid for the property at purchase from the total sale price of the property. Thus the payments you receive are not taxable.

For example lets say a single person bought a house for 100k and sold it for 400k. If you take a reverse morgage you get tax free income initially and then part of the proceeds from the sale go to the financial institution. If youre single up to 250000 of.

The IRS lets the first 250000 of capital gains slide if you are single and 500000 of the capital gains slide if you are married filing jointly. Capital Gains Tax and Reverse Mortgages One area where a reverse mortgage could have an indirect impact on your taxes is in the area of capital gains or profits from selling an asset. A real client story about a couple considering a reverse mortgage to potentially eliminate a 225000 capital gains tax liability.

As a higher rate taxpayer Barry will. 5 tax implications of a reverse mortgage 1. Have 50000 profit before capital gains tax.

If the heirs want to. The proceeds from a reverse mortgage are generally not taxable upon receipt. If the result is a positive number you have a capital gain of that amount.

Selling your home doesnt happen often with a reverse mortgage since it is best practice to remain in your home while you have one however sometimes it is necessary. In the Upcoming weeks we will be uploading short videos on impor. Make a real capital gain of 120000 150000 30000 Pay off his mortgage of 100000.

Your capital gains tax liability is calculated on the real capital gain. Receiving money from the lender As per the tax laws profits made on the transfer of a capital asset is treated as a capital gain and taxed. They may become taxable at termination if any portion of the unpaid principal balance is not paid in full by the borrower or heirs.

Any profits you make beyond the 250000 or 500000 will be taxed. How does that affect the capital gains in cases where you have more than the 250500k exclusion. The money you receive from a reverse mortgage isnt taxable income.

In Barrys case this is 120000. In the eyes of the IRS. The lender pays you the borrower loan proceeds in a lump sum a monthly advance a line of credit or a combination of all three while you continue to live in your home.

However Section 47 16 of the Income Tax Act 1961 provides that the act of mortgaging the property for reverse mortgage will not be treated as a transfer. If the property purchased with a reverse mortgage is sold before the death of the owner after it appreciates 250000 in value 500000 for a married couple then there will be capital gains tax due on the sale Brown explains. With a reverse mortgage you retain title to your home.

Minimum amount that can be granted is three lakhs and maximum up to 1 crore in general but this may also vary for different banks. Loan amount granted under reverse mortgage scheme is maximum up to 90 percent of the value of the property but varies from bank to bank range being 50 -90. To find out how much you c.

Under federal income tax law and regulation reverse mortgages are no different than any other non-recourse mortgage. On the plus side reverse mortgages are considered loan advances to you not income you earned. No reverse mortgage payments arent taxable.

You could owe capital gains taxes when you or a family member sells your home to pay off the reverse mortgage. Hi guys in this video we have covered Reverse Mortgage Scheme from Capital Gains Chapter. Moreover they usually dont affect your Social Security or Medicare benefits.

How To Pay No Capital Gains Tax After Selling Your House

How To Pay No Capital Gains Tax After Selling Your House

How Capital Gains And Proposition 13 Affect Reverse Mortgages

How Capital Gains And Proposition 13 Affect Reverse Mortgages

Topic Capital Gains Basis Of Charge Us 451

Topic Capital Gains Basis Of Charge Us 451

How Capital Gains And Proposition 13 Affect Reverse Mortgages

How Capital Gains And Proposition 13 Affect Reverse Mortgages

Reverse Mortgages And Taxes Retirement Living 2021

Reverse Mortgages And Taxes Retirement Living 2021

Taxation Of Capital Gains Issues Thereunder

Taxation Of Capital Gains Issues Thereunder

Tax Deductions For Reverse Mortgage Borrowing Payments

Tax Deductions For Reverse Mortgage Borrowing Payments

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

Reverse Mortgage What Are The Tax Liabilities Housing News

Reverse Mortgage What Are The Tax Liabilities Housing News

Reverse Mortgage Tax Strategy Youtube

Reverse Mortgage Tax Strategy Youtube

What Is A Reverse Mortgage Loan Everything You Need To Know About It

What Is A Reverse Mortgage Loan Everything You Need To Know About It

Financial Freedom Reverse Mortgage Forget Capital Vector Image

Financial Freedom Reverse Mortgage Forget Capital Vector Image

Reverse Mortgages And Taxes Retirement Living 2021

Reverse Mortgages And Taxes Retirement Living 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.