If you are requesting information to file an income tax return for the current tax year request a copy of Form W-2 from your employer. Notify your employer directly about a lost W-2 form.

Lost W2 No Problem Lost W2 Help Community Tax Community Tax

Lost W2 No Problem Lost W2 Help Community Tax Community Tax

Use Form 1040X Amended US.

Lost w 2. Whether your W2 was lost in the mail or you accidentally threw it away its. It doesnt matter if you have your W-2 or not. If even after nudging from the IRS your employer doesnt send you a replacement W-2 in time for you to file your tax return you may file using Form 4852 in place of your missing wage statement.

Individual Income Tax Return to make the change. If you have lost your W-2 for any of the past 10 years you can contact the IRS directly to request a copy to allow you to file your taxes accurately. We cannot provide you with information for the current tax year until May 18.

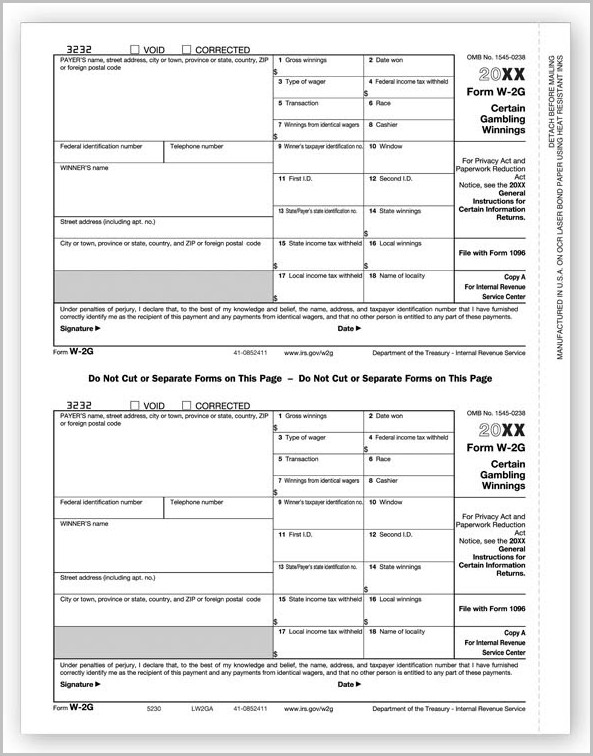

Another option is to apply for an extension to file your taxes. Contact your current employer and past employers human resources offices--either in person or by mail--and ask for a copy of your W-2. Similarly if you are a self-employed consultant with a missing 1099 reporting income from a consulting engagement you can contact the issuerthe customer that paid youfor a replacement.

If the tax information on the W-2 is different from what you originally reported you may need to file an amended tax return. Allow enough time for the company to issue and mail a replacement. A W2 is a crucial document that verifies your income and taxes paid throughout the year and must be used to file taxes properly.

For instance if you have wages and tax withholdings from an employer but lack the W-2 statement a lost W-2 replacement can be as simple as asking your employer for a duplicate. The form reports how much you earned and the amount of taxes witheld from your paycheck. To file your tax return on time when you have a missing or lost W-2 use Form 4852 the substitute for form W-2.

In a case where you already contacted the IRS regarding your missing W-2 they will get you to complete Form 4852 which will function as a Form W-2. Use Form 1040X Amended US. Filing an extension using Form 4868 will allow you to delay filing a return until Oct.

If youve lost your W2 dont despair. These things are kinda different for each state did you try a google search for duplicate w-2 and the name of the state. Getting a second copy of a W2 form is easy - all you need to do is admit I lost my W2 and then ask for another.

You can find this form on the official IRS website. It can take as little as 2 days to have the lost W2 emailed to your inbox. Request a replacement W-2 from the department responsible for payroll.

Individual Income Tax Return to make the change. The second season of the American serial drama television series Lost commenced airing in the United States and Canada on September 21 2005 and concluded on May 24 2006. If youve lost a W-2 or if you never got one in the first place there are a few things you can do but you better act quick.

What if you didnt receive or lost your Form W-2. According to the IRS you still have to file your tax return or request a tax extension by April 15. Avsnitten innehåller vanligtvis en huvudhistoria som utspelar sig på ön samtidigt som man får följa en sekundär berättelse från en annan tidpunkt i en rollfigurs liv.

You may need to correct your tax return if you get your missing W-2 after you file. You may need to correct your tax return if you get your missing W-2 after you file. Unfortunately you may be placed on hold with the IRS for over an hour before you can even talk to anyone about getting a.

Lost är en amerikansk tv-serie som följer de överlevande från en flygolycka på en mystisk tropisk ö. Keeping your paystubs allows you to file a substitute form to make sure you complete. If you have lost your W-2 or never received one from an employer you can recover or replace it.

Important 2015 Health Insurance Forms. If the tax information on the W-2 is different from what you originally reported you may need to file an amended tax return. Most w-2 copies are sent to the government dispite what you do so you could call llike a ss office in your area and ask them how you can get a duplicate w-2.

Your employer is supposed to send a W-2 to both you and the Internal Revenue Service. If for some reason your tax form disappeared completely dont worry. Alternatively taxpayers can contact the Internal Revenue Service and ask for another copy of the lost W2.

Just File Your Return Without The W-2.

Lost W 2 Here S What To Do If You Need A New Form Huffpost

Lost W 2 Here S What To Do If You Need A New Form Huffpost

Get A Copy Of Lost W2 Or Missing W 2 Download Old Form Now Retrieve Copies

Get A Copy Of Lost W2 Or Missing W 2 Download Old Form Now Retrieve Copies

:max_bytes(150000):strip_icc()/Clipboard01-779726998cf64e9085a5319a27cc25f4.jpg) Form W 2 Wage And Tax Statement Definition

Form W 2 Wage And Tax Statement Definition

Get A Copy Of Lost W2 Or Missing W 2 Download Old Form Now Retrieve Copies

Get A Copy Of Lost W2 Or Missing W 2 Download Old Form Now Retrieve Copies

3 Ways To Get Copies Of Old W 2 Forms Wikihow

3 Ways To Get Copies Of Old W 2 Forms Wikihow

Haven T Got Your Tax Documents Yet Here S What To Do The Lima News

Haven T Got Your Tax Documents Yet Here S What To Do The Lima News

What To Do About A Lost W 2 Check Stub Maker

What To Do About A Lost W 2 Check Stub Maker

3 Ways To Request A Duplicate W 2 Wikihow

3 Ways To Request A Duplicate W 2 Wikihow

What To Do If You Ve Lost Your W 2 Form For 2020 2021

What To Do If You Ve Lost Your W 2 Form For 2020 2021

3 Ways To Request A Duplicate W 2 Wikihow

3 Ways To Request A Duplicate W 2 Wikihow

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.