If you have concerns that a product is priced inappropriately please complete the Prohibited Product Policy form below. Please do not write on your tax certificate.

How To Get Walmart Tax Exempt Status Step By Step Tax Exemption Process Revealed Youtube

How To Get Walmart Tax Exempt Status Step By Step Tax Exemption Process Revealed Youtube

I was told the only way to do it would be to add it into your account when its created.

How to do tax exempt on walmart com. Sales Tax Exempt Certificate - Walmart. I made a purchase that was supposed to be tax exempt. The service desk person will hate you but at least you saved money.

Sales Tax License Local City Sales Tax License if Home Rule click here for list CT. You can update your product tax ID code directly on GeekSeller Walmart panel individually or in bulk with CSVXLS file. Your order will be taxed and a refund generated as soon as our Tax Department verifies your tax exempt information.

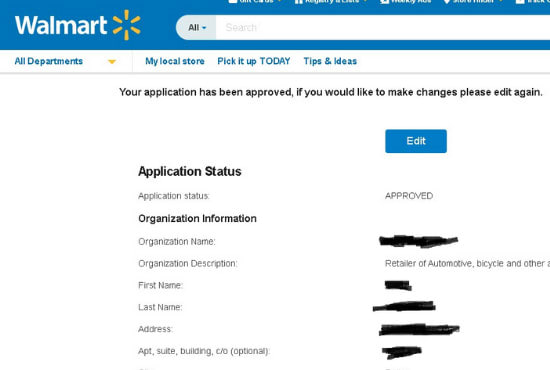

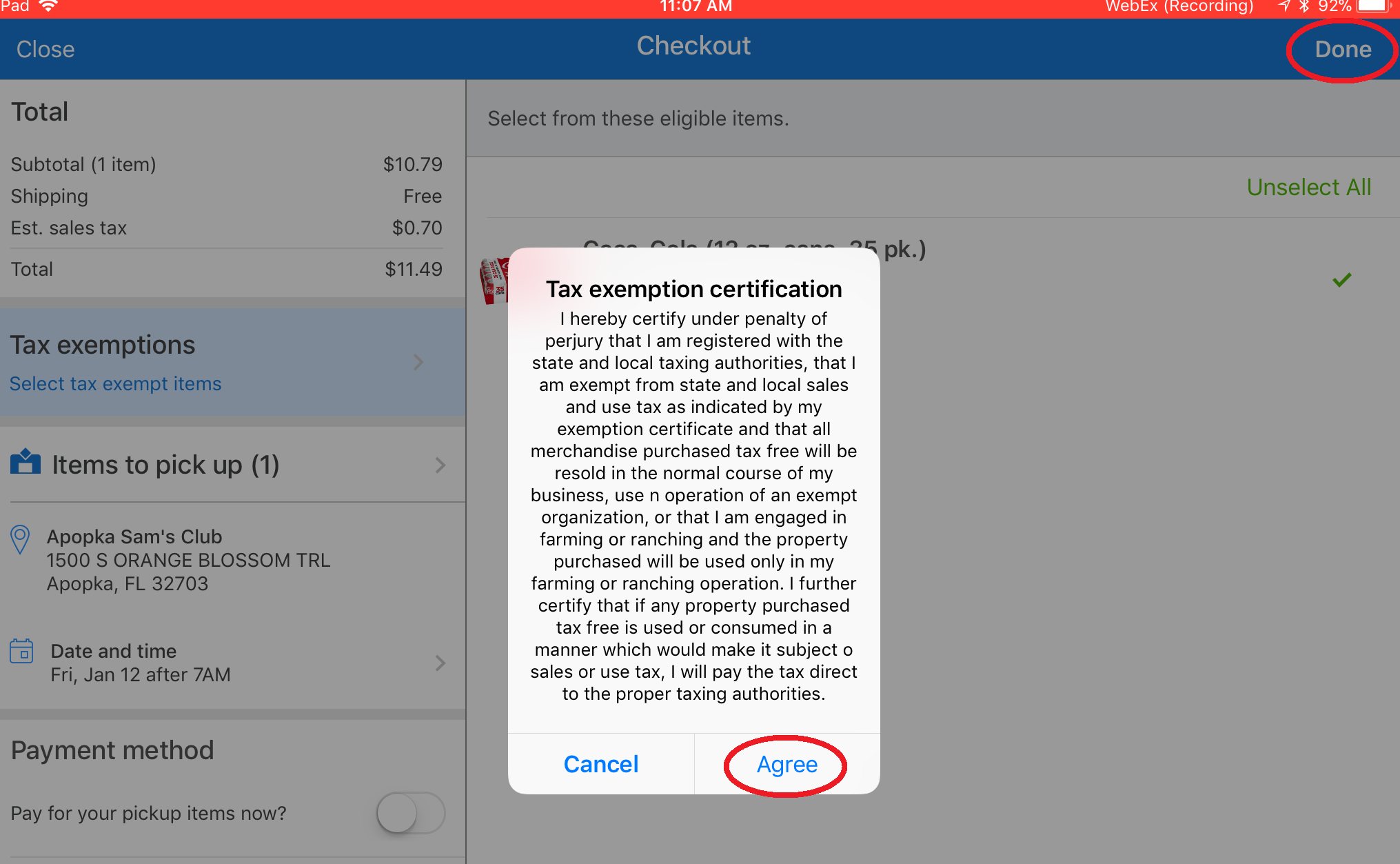

As a potential supplier one of the most important things you can do is to understand our minimum requirements. As you can see the process of getting Tax Exempt at Walmart is simple enough. Otherwise it has to be added each time.

You should receive a response within 2 business days. PDF JPG PNG or TIFF For each state where youll make purchases or where youll have orders shipped. If all else fails buy it regular return it then have them re ring it up as tax exempt.

Wal-Mart claims that it currently partners with more than 45 Illinois-based. All you need is just to provide all the required documentation. Opens in new window Other eligibility requirements similar to purchasing Walmart items will also apply.

Requires this number on all US-based suppliers application documents. You can contact us here option for GeekSeller users only. However keep in mind that we have merely provided you with an overview of getting tax-exempt since before setting up this process you have to contact a legal and tax professional service like Prestige Auditors.

Fax your tax certificate to Staples at 18888238503. Sales Use Tax Permit FL. I was charged tax for one item which added to my bill.

We have some current frequently asked questions and answers to helpIf you need to return an item you can start this from your account. From a quick Google search it says that the store is required by law to collect sales tax through brick and mortar Nexus law. If you have tax-exempt status we will remove taxes on all applicable items.

In other cases a specialist will guide you. Once youre approved you can make tax-exempt purchases immediately. On a cover sheet please include your telephone number and order number if applicable.

Just make sure youre splitting up taxable and non-taxable purchases. Federal Taxpayer Identification Number TIN Walmart Inc. Have your receipt and covered item with you Many claims are approved instantly.

DR-13 for Retailers or DR-14 for Non-Profit Government Schools Tobacco Dual License if applicable GA. If you need help with updating those codes you can send us a file with SKUs and associated tax codes and we can make an update for you. The lower the number the higher the tax deductions each pay and the bigger income tax check.

The higher the number the less tax deductions each check but you may owe at income tax. Sales Tax Exempt Certificate - Walmart. When I noticed the next day and requested to have the tax credited back to my account customer service refused because of the type of item purchased.

I did not want to return the item just wanted the. Suppliers must provide a current W-8 tax certificate as a part of the supplier setup process. Once approved all purchases made with this account will be sales tax exempt.

It may take up to 3 business days for your status to be approved. I purchased a Glucometer for use by the police department. Yes Marketplace items are eligible for the Walmart Tax Exempt Program if the order is shipped to a state that has adopted the marketplace facilitator sales tax collection requirements.

Tax exemption certificate in one of these formats. To get started apply for tax exemption on the Walmart site. Thank you for visiting our Help Center.

Sales Tax Certificate of Registration Sales Tax Number. For a list of the states click here.

Get You Amazon Tax Exempt In All States The Legal Way By Ayoubhassab Fiverr

Get You Amazon Tax Exempt In All States The Legal Way By Ayoubhassab Fiverr

How To Get Tax Exempt At Walmart Prestige Auditors

How To Get Tax Exempt At Walmart Prestige Auditors

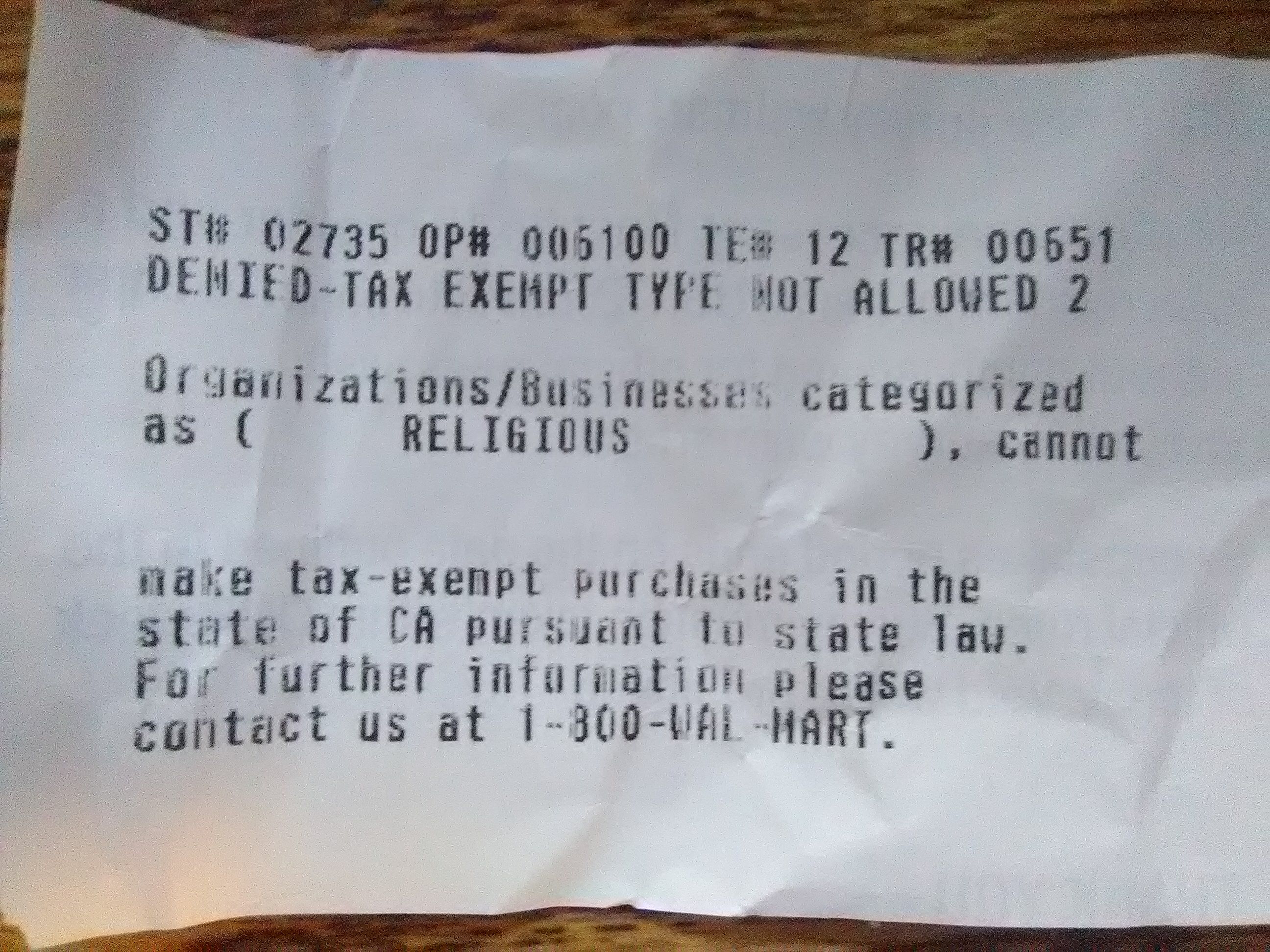

Denied Tax Exempt Purchase At Wal Mart Steemit

Denied Tax Exempt Purchase At Wal Mart Steemit

Do Walmart Sales Tax Exemption In All States By Rawal16 Fiverr

Do Walmart Sales Tax Exemption In All States By Rawal16 Fiverr

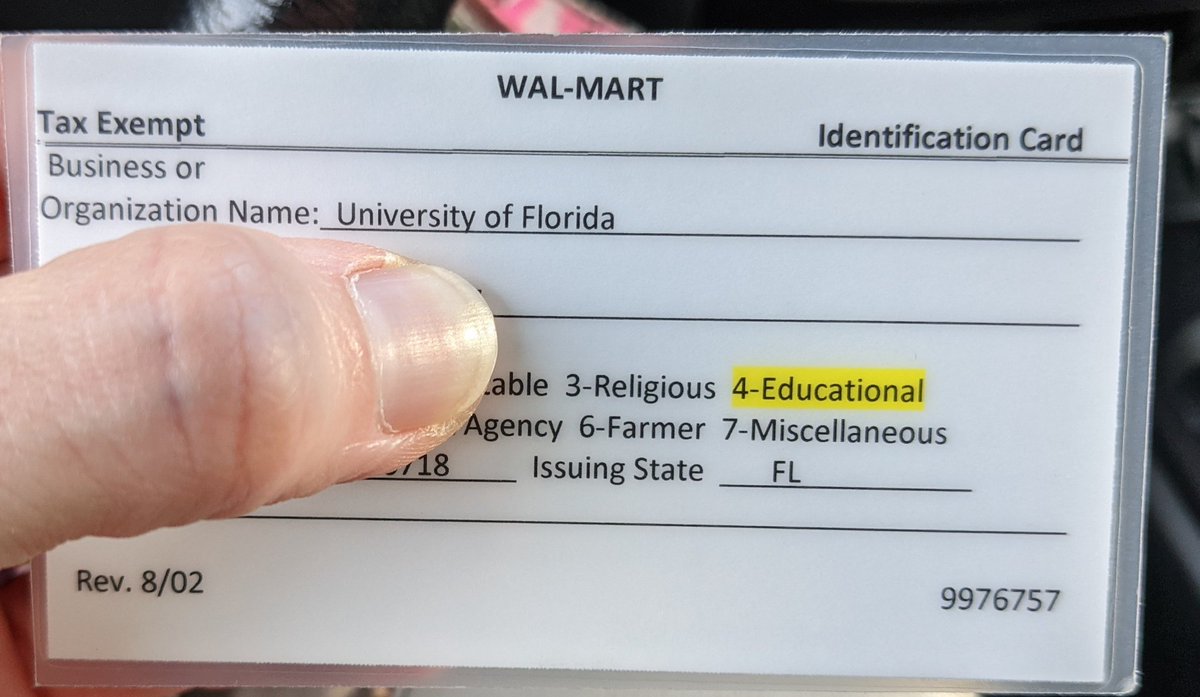

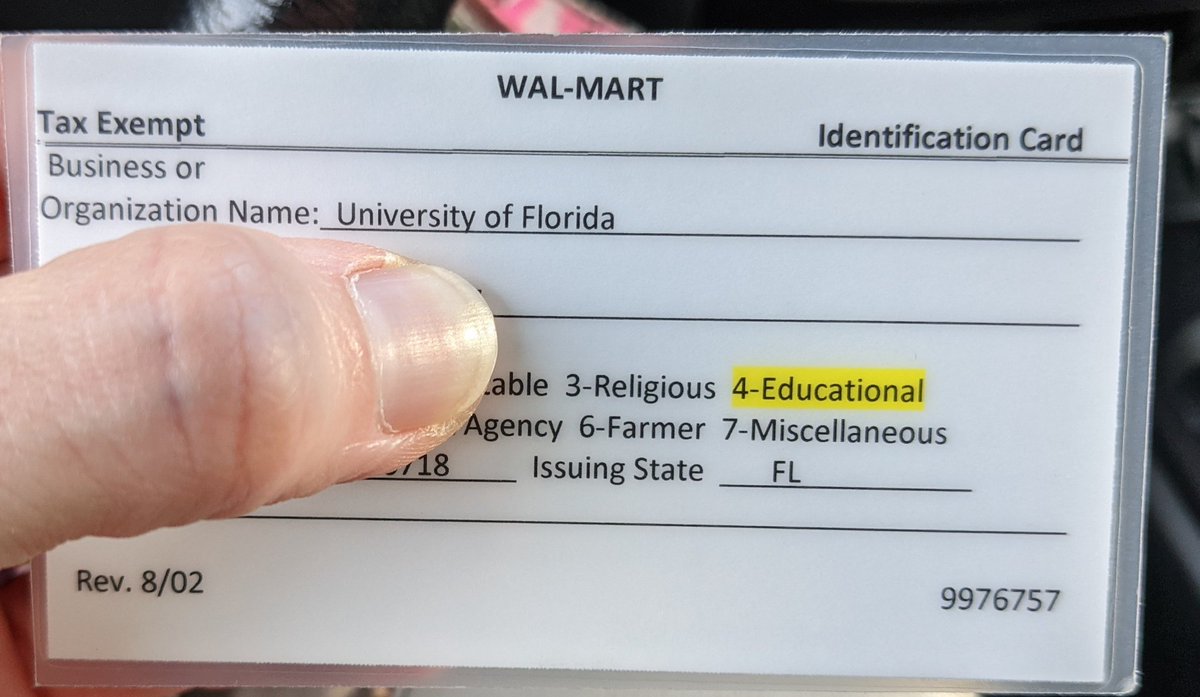

Dr Lauren Diepenbrock She Her On Twitter Thanks Walmart For Wasting Time This Morning And Not Accepting The Tax Exempt Card Given To Uf With Our Purchasing Cards Guess Amazon Will Get That

Dr Lauren Diepenbrock She Her On Twitter Thanks Walmart For Wasting Time This Morning And Not Accepting The Tax Exempt Card Given To Uf With Our Purchasing Cards Guess Amazon Will Get That

Do Your Own Nonprofit Arkansas Do Your Own Nonprofit The Only Gps You Need For 501c3 Tax Exempt Approval Paperback Walmart Com Walmart Com

Do Your Own Nonprofit Arkansas Do Your Own Nonprofit The Only Gps You Need For 501c3 Tax Exempt Approval Paperback Walmart Com Walmart Com

Walmart Tax Exemption Online Application For Dropshipping How To Increase Your Ecommerce Profits Youtube

Walmart Tax Exemption Online Application For Dropshipping How To Increase Your Ecommerce Profits Youtube

How To Make Tax Exempt Purchases In Retail And Online Stores How To Make Money On The Internet

Every Nonprofit S Tax Guide How To Keep Your Tax Exempt Status Avoid Irs Problems Edition 6 Paperback Walmart Com Walmart Com

Every Nonprofit S Tax Guide How To Keep Your Tax Exempt Status Avoid Irs Problems Edition 6 Paperback Walmart Com Walmart Com

How To Get Tax Exempt On Walmart Step By Step Guide To Walmart Tax Exemption Youtube

How To Get Tax Exempt On Walmart Step By Step Guide To Walmart Tax Exemption Youtube

Amazon Fba Sales Tax Collection 2021 Usa Everything You Need To Know Just One Dime Blog

Amazon Fba Sales Tax Collection 2021 Usa Everything You Need To Know Just One Dime Blog

Get You Walmart Tax Exempt In All States The Legal Way By Ayoubhassab Fiverr

Get You Walmart Tax Exempt In All States The Legal Way By Ayoubhassab Fiverr

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.