Taxpayers who took the credit on their federal income tax returns in 2008 are obligated to repay the tax credit over 15 years beginning with their 2010 tax returns. To keep a campaign promise the President called on Congress to pass a tax credit for first-time homebuyers and two House members have answered the call.

Can First Time Home Buyers Get A Tax Credit

Can First Time Home Buyers Get A Tax Credit

If youre still looking for the first-time homebuyer credit it unfortunately no longer exists.

Is there still a first time homebuyers tax credit. Even though the first-time homebuyer tax credit is no longer in use there are several tax breaks that many homebuyers in 2015 and 2016 including first-time. You or your spouse or common-law partner acquired a qualifying home you did not live in another home owned by you or your spouse or common-law partner in the year of acquisition or in any of the four preceding years first-time home buyer. If passed the funds.

Balance of your First-Time Homebuyer Credit. The Home Buyers Amount HBA is a non-refundable credit that allows first-time purchasers of homes and purchasers with disabilities to claim up to 5000 in the year when they purchase a home. However people who purchased homes before 2010 can still benefit from the tax credit initiative.

We recently received an inquiry from a reader asking Is the first-time homebuyer tax credit still available Unfortunately the answer is no. A 6500 first-time home buyers tax credit was also available for consumers who bought their first home between Nov. If you purchased and closed on your home between April 8 2008 and Sept.

What is the First-Time Home Buyers Tax Credit. But the IRS website states that the 2009 tax credit was intended for new home owners who have not owned a home in the prior three years We expect to see similar requirements this time around. The size of the credit does depend on the area of the country you happen to live in.

30 2010 and you were otherwise eligible for the credit you may have claimed the credit when filing your income tax return in 2008 2009 or 2010. If youre buying a home for the first time claiming the first-time homebuyer credit can land you a total tax rebate of 750. Theres currently no federal tax credit for todays first-time homebuyers.

Specifically you may still be eligible if your closing took place on or before September 30 2010. The first-time homebuyer tax credit has been expired for several years. The short answer is unfortunately no.

The First-Time Home Buyers Tax Credit is a 5000 non-refundable tax credit. Go to our First-Time Homebuyer Credit Account Look-up to receive. Fear not just because the First-Time Homebuyer tax credit has expired that doesnt mean there arent any incentives available for those looking purchase their first property.

Among other things that act offered an 8000 tax credit to eligible first-time home buyers. It provides a 20 mortgage interest credit of up to 20 of interest payments. The First-Time Home Buyers Tax Credit.

To be eligible for the Home Buyers Tax Credit you must meet both of these criteria. Amount you paid back to date. You received a First-Time Homebuyer Credit.

Legislation was introduced in the Senate in 2018 to renew the credit but Congress didnt act on the bill. Far from it in. Social Security number or your IRS Individual Taxpayer Identification Number.

The new homeowners tax credit that many filers are familiar with is the First-Time Homebuyer Credit which was passed in 2008 under HERA or the Housing Economic and Recovery Act under Obama. You can claim 5000 for the purchase of a qualifying home in the year if both of the following apply. Bidens 15000 first-time homebuyer tax credit explained Consumers would get a payment when they buy a house not at tax time August 26 2020 618 pm By Kathleen Howley Former Vice President Joe.

Updated October 28 2020 The first-time homebuyer tax credit ended in 2010 at least for most taxpayers but it still applies to those who purchased homes in 2008 2009 or 2010. The program ended in 2010. The housing industry is keeping a close eye on the Biden administrations proposal of a 15000 first-time homebuyer tax credit.

Is There a Tax Credit for First Time Home Buyers. 7 2009 and April 30 2010. 3 May 2021 1701 EDT.

While 750 isnt a life-changing amount of money it can make buying your first home a little bit easier. The rules for repayment of the 2010 tax credit are. Mortgage Tax Credit Deductions Theres a program called the Mortgage Credit Certificate MCC designed for low-income homebuyers who are making a purchase for the first time.

Biden S 15 000 First Time Homebuyer Tax Credit Youtube

Biden S 15 000 First Time Homebuyer Tax Credit Youtube

First Time Home Buyer Tax Credit Mr Williamsburg Revolutionary Ideas On Real Estate Hampton Roads Virginia

First Time Home Buyer Tax Credit Mr Williamsburg Revolutionary Ideas On Real Estate Hampton Roads Virginia

How President Biden S Proposed First Time Homebuyer Tax Credit Could Affect Millennial Home Buying

How President Biden S Proposed First Time Homebuyer Tax Credit Could Affect Millennial Home Buying

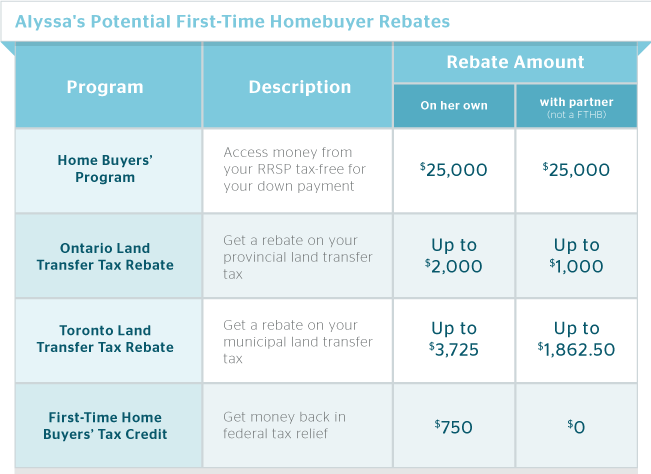

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

First Time Homebuyer Tax Credit Potential Benefits And Consequences Rismedia

First Time Homebuyer Tax Credit Potential Benefits And Consequences Rismedia

How President Biden S Proposed First Time Homebuyer Tax Credit Could Affect Millennial Home Buying

How President Biden S Proposed First Time Homebuyer Tax Credit Could Affect Millennial Home Buying

Is The First Time Homebuyer Tax Credit Still Available The Motley Fool

Is The First Time Homebuyer Tax Credit Still Available The Motley Fool

Do I Have To Pay Back First Time Homebuyer Tax Credit

Do I Have To Pay Back First Time Homebuyer Tax Credit

What Is The First Time Home Buyers Tax Credit And How Does It Work Ratehub Ca

What Is The First Time Home Buyers Tax Credit And How Does It Work Ratehub Ca

First Time Home Buyer S Tax Credit Tribe Financial

First Time Home Buyer S Tax Credit Tribe Financial

Does The First Time Homebuyer Buyer Tax Credit Still Exist What Are My Options

Does The First Time Homebuyer Buyer Tax Credit Still Exist What Are My Options

The First Time Home Buyer Tax Credit Nerdwallet

The First Time Home Buyer Tax Credit Nerdwallet

What Is The First Time Home Buyer Credit And Will It Ever Come Back Forbes Advisor

What Is The First Time Home Buyer Credit And Will It Ever Come Back Forbes Advisor

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.