The IRS requires that you start taking minimum required distributions when you reach 70½ years old. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

Roth IRAs do not require withdrawals until after the death of the owner.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Taking money out of ira. For the 2020 tax year the. If you only own a Traditional IRA your first 10000 in withdrawals can also be penalty-free but you still need to set money aside to pay distribution taxes. Once you turn age 59 12 you.

These are considered normal IRA distributions. Taking Money Out of an IRA Penalty-Free 7 Ways 1. Then the 401k contribution offsets the income you take out from the.

Also first-time home is defined pretty loosely. The IRS does not require you to withdraw from a Traditional or Rollover IRA until you reach the age of 72. Just like the education exclusion you can also tap this option for the benefit of your family.

But you dont have to start at that age you can choose to let the account sit and grow for another 11 years if you choose. If you are married your spouse can do the same. For the purposes of the IRS it is your first-time home if you have not had ownership interest in a home for the past two years.

You can take money out of an IRA whenever you want but be warned. You can take funds out of your traditional IRA and no penalty taxes will apply after you reach age 59 12. If youre under age 59 ½ it could cost you.

Delay IRA withdrawals until age 59 12. A 2055 fund is going to be extra heavily heavy towards stocks. You can take money out of an IRA anytime.

What if I withdraw money from my IRA. If you use IRA money to pay for higher education for yourself your spouse children or grandchildren you. This increases your taxable income she said.

You generally have to start taking withdrawals from your IRA SEP IRA SIMPLE IRA or retirement plan account when you reach age 72 70 ½ if you reach 70 ½ before January 1 2020. If you havent purchased a home within two years you can use up to 10000. Its called a 2025 fund since if youre planning to retire really quickly you do not have the luxury of awaiting a recovery in case of a stock market downturn.

To make sure thats what a fund of funds appears like. Take a distribution from your inherited IRA for the same amount. How to take money out of an Roth IRA without penalty.

Additionally traditional IRA distributions exist as taxable income. You can take up to 10000 out of your IRA penalty-free for a first-time home purchase. A big exception for the 10 percent penalty is when.

There are exceptions to the 10 percent penalty such as using IRA funds to pay your medical insurance premium after a job loss. You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. Only withdraw up to 10000 from your Roth IRA and your spouses Roth IRA Following these three steps means you can make an early IRA withdrawal thats tax-free and penalty-free.

To take advantage of this tax-free withdrawal the money must have been deposited in the IRA and held for at least five years and you must be at least 59½ years old. If youre 59½ or older youre allowed to withdraw from your IRA without penalty. You can take money out of an IRA before you turn 59-12 without paying the 10 percent penalty in a few other ways without invoking the 72 t.

How to take money out of an Roth IRA without penalty. Thats because the government wants to discourage you from raiding your IRA until. Traditional IRA Withdrawal Rules You can start taking money out of your IRA penalty-free at age 59½.

Among the many other things it does the Act gives you the penalty-free option to take money out of your 401 k plan or IRA before you are 59½. However depending on your account type Traditional or Roth you may be taxed on your withdrawal. The annual amount you can contribute to a Roth IRA is limited and can be phased out depending on how much income you earn.

But taking money out of an IRA prior to reaching age 59 ½ and failure to meet certain IRS exceptions will result in a 10 percent penalty tax on the amount withdrawn. If you need the money before.

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Traditional Roth Iras Withdrawal Rules Penalties H R Block

What Are Traditional Ira Withdrawal Rules Ramseysolutions Com

What Are Traditional Ira Withdrawal Rules Ramseysolutions Com

Rules For Taking Rmds From Your Retirement Savings

Rules For Taking Rmds From Your Retirement Savings

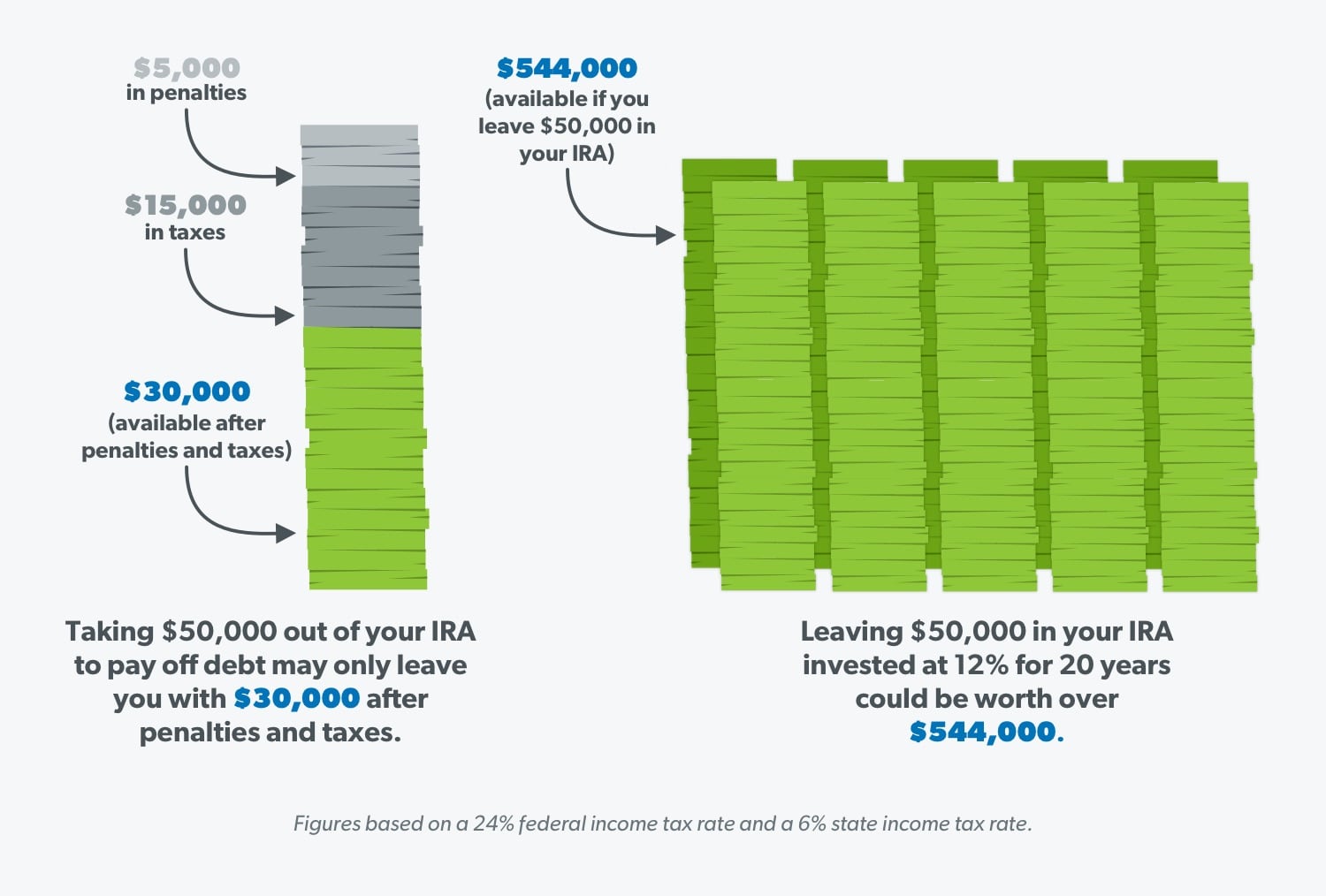

Should I Take Money Out Of My Ira To Pay Off Debt Ramseysolutions Com

Should I Take Money Out Of My Ira To Pay Off Debt Ramseysolutions Com

401 K Withdrawal Age And Early Withdrawal Rules Smartasset

401 K Withdrawal Age And Early Withdrawal Rules Smartasset

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png) Exceptions To The Ira Early Withdrawal Penalty

Exceptions To The Ira Early Withdrawal Penalty

12 Ways To Avoid The Ira Early Withdrawal Penalty Iras Us News

12 Ways To Avoid The Ira Early Withdrawal Penalty Iras Us News

Taking Cash Out Of Your Ira Under The Cares Act Is More Complicated Than It Sounds Marketwatch

Taking Cash Out Of Your Ira Under The Cares Act Is More Complicated Than It Sounds Marketwatch

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg) Roth Ira Withdrawals Read This First

Roth Ira Withdrawals Read This First

/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png) Can I Withdraw Money From My 401 K Before I Retire

Can I Withdraw Money From My 401 K Before I Retire

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

/Takingmoneyoutofanira-98057a4d86a843f99b9141cd5c111009.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.