I believe IDES deducts 50 cents on the dollar of what you make per week out of your weekly benefit. Divide what you make per week in half and subtract it from your weekly benefit.

Do You Know Your Unemployment Benefits Independent Contractor Tax Advisors

Do You Know Your Unemployment Benefits Independent Contractor Tax Advisors

If you received unemployment compensation you.

If i collected unemployment will i get a w2. Search for unemployment compensation and select the Jump to link. May be required to make quarterly estimated tax payments or. Your state unemployment office should send you the 1099-G form listing that amount but there are ways to request the form in the mail.

When you filed for unemployment you would have been asked if you wanted taxes taken out. If you were out of work for some or all of the previous year you arent off the hook with the IRS. Tax credits put money back in your pocket.

Also thanks to the American Recovery and Reinvestment Act ARRA the first 2400 of unemployment income is untaxed. Open or continue your tax return in TurboTax online. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

If you received payments for unemployment benefits you will get a Form 1099-G. Can choose to have federal income tax withheld from your unemployment compensation. Your unemployment payments were not earned income.

You will get a form similar to a W2 but I believe it is a 1099 something or other. Earned Income Tax Credit EIC Child tax credits. Not all unemployment payments are treated the same for tax purposes.

If you received unemployment your tax statement is called form 1099-G not form W-2. Claiming the standard deduction. If you received unemployment compensation you should receive Form 1099-G showing the amount you were paid and any federal income tax you elected to have withheld.

Unemployment compensation you received under the unemployment compensation laws of the United States or of a state must be included in your income. - Answered by a verified Tax Professional. I have mine from my employer but i lost my unemployment w2.

How to Pay Taxes for Unemployment Compensation. We use cookies to give you the best possible experience on our website. Limited interest and dividend income reported on a 1099-INT or 1099-DIV.

If you were out of work for some or all of the previous year you arent off the hook with the IRS. You do NOT get a W2 from unemployment unless you worked for the unemployment office. Contractors dont earn benefits or have taxes withheld from their wages and at the end of the year youll receiving a 1099 instead of a W-2 so sometimes people refer to contracting work as a 1099 position.

If you are unemployed in 2021 and receiving unemployment compensation you may want to. Such jobs can provide much-needed income but it may affect your unemployment benefits. Whether or not you are on unemployment doesnt disqualify you from applying for a PPP loan.

Will i get a w2 from unemployment. Youll also need this form if you received payments as part of a governmental paid family leave program. Heres how you enter the unemployment.

A W2 form reports earned income. The unemployment workplace will deliver you a kind akin to a W2 if no longer an truly W2 that declares how plenty they paid you for 2007 and how plenty in taxes have. How Do I Get My Ct Unemployment W2.

It is a form 1099G and they are usually not received until Feb 15 F1099 dont have the same mailing requirements as W2s. You must report the unemployment on your tax return and if you didnt have. They arrive at the end of the month.

On the Did you receive unemployment or paid family leave. I lost my w2 from unemployment how do i get a new one. If you received unemployment compensation from a union private voluntary fund or as a state employee you might not get a 1099-G.

Refer to Form W-4V Voluntary Withholding Request and Tax Withholding. You do have to pay taxes on it anyway so even if you did not have it taken out you will see it affect your return. While the tax rate is identical that is a dollar of wages faces the same income tax rate as does a dollar of unemployment benefits they are not identical items.

In any event you should list your unemployment income should on your return. Yes unemployment compensation is reported on your tax return differently than and separately from W-2 wage income. Answer 1 of 6.

You have to report the income but can collect unemployment depending on how much you make. Federal state or District of Columbia unemployment benefits are included in Form 1099-G but if your former employer provides its own supplemental unemployment payments these are taxed as regular wages and reported on Form W-2. Sarah the answer is yes and no.

It is taxable income. Unemployment Income reported on a 1099-G. Its possible that receiving a PPP loan for your 1099 may disqualify you from receiving unemployment benefits for your W-2 so you should check with your local unemployment.

Taxes arent withheld automatically from unemployment benefits. A simple tax return is Form 1040 only without any additional schedules OR Form 1040 Unemployment Income.

Can You Collect Unemployment If You Have A Side Business Bankrate

Can You Collect Unemployment If You Have A Side Business Bankrate

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

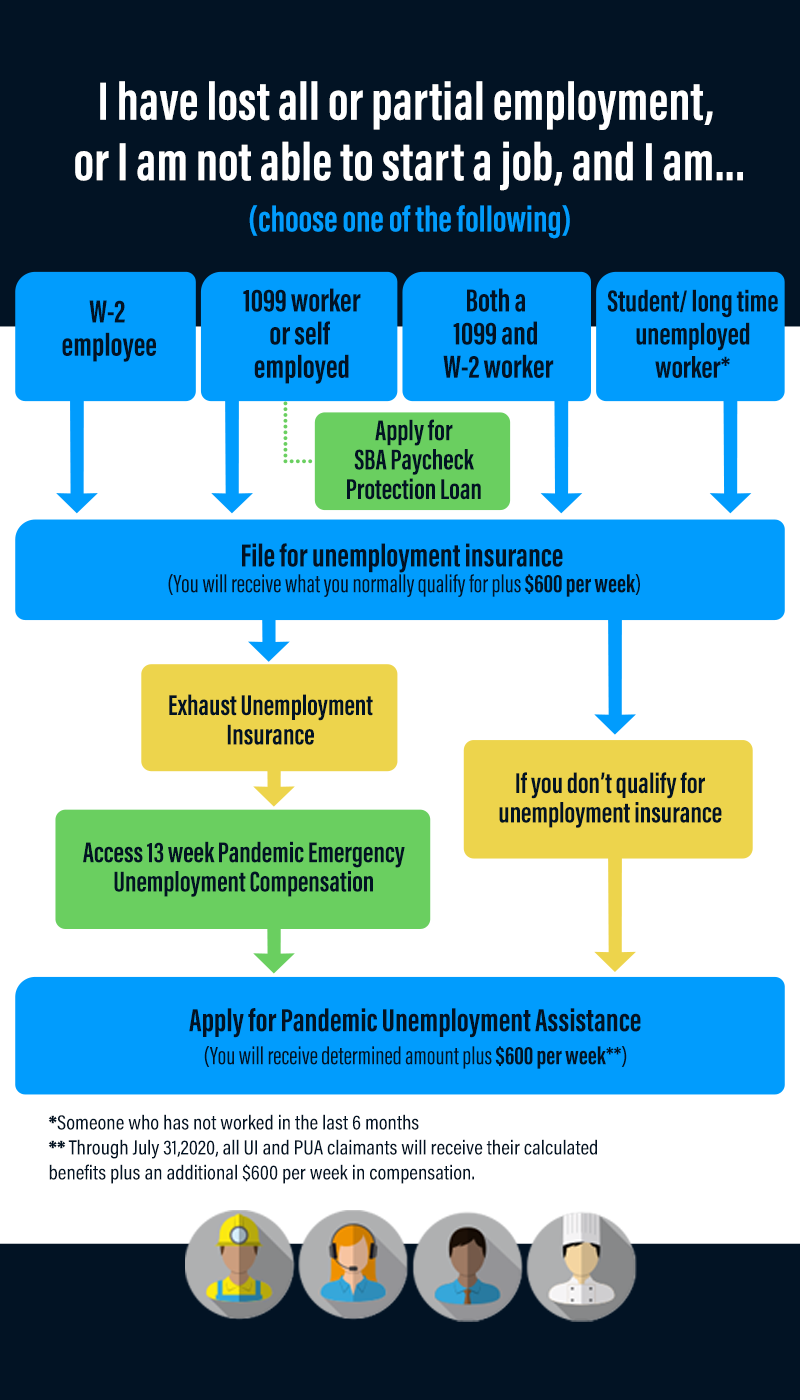

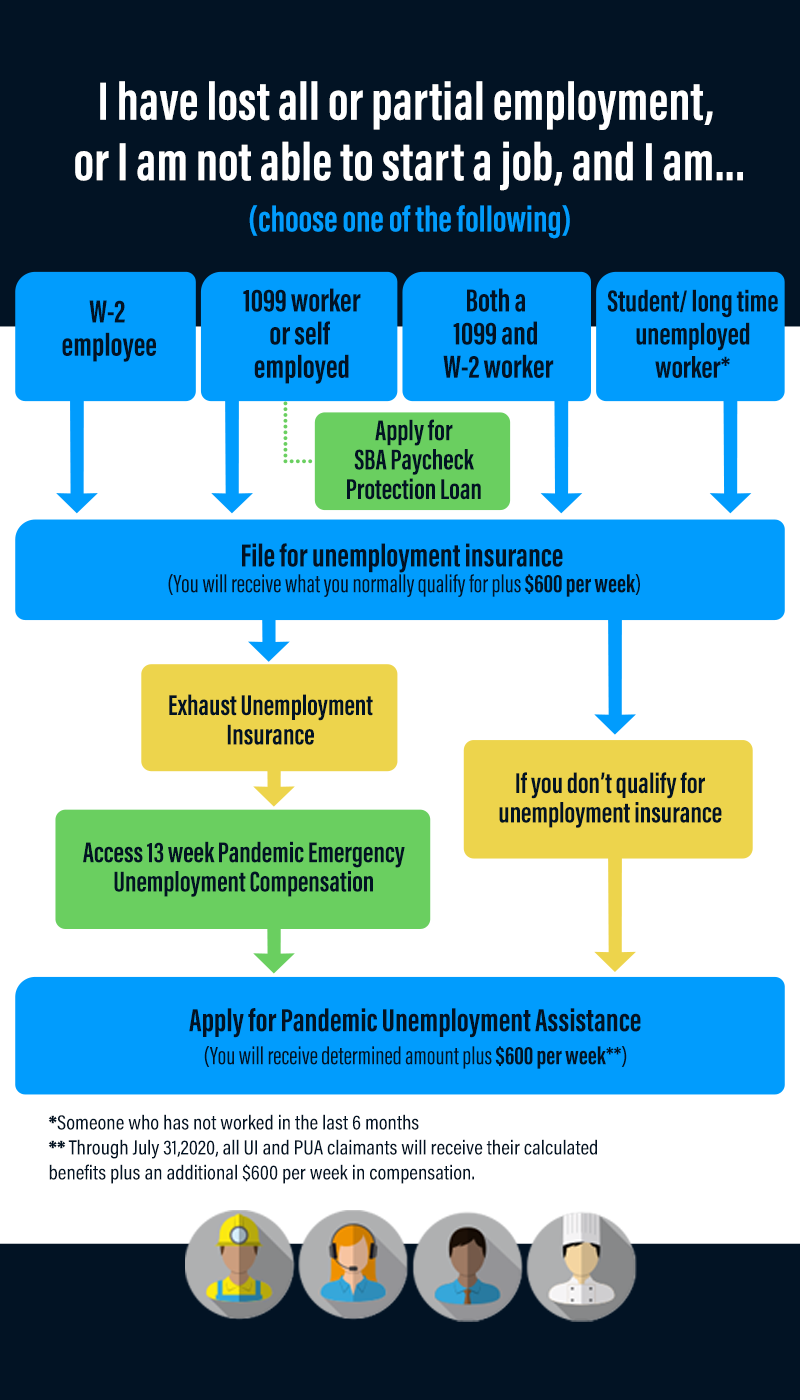

Unemployment Assistance Assembly Democratic Caucus

Unemployment Assistance Assembly Democratic Caucus

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

:max_bytes(150000):strip_icc()/can-i-collect-unemployment-if-i-am-fired-2064150-v2-5babf19246e0fb0025a74968.png) Collecting Unemployment Benefits For Self Employed Workers

Collecting Unemployment Benefits For Self Employed Workers

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png) How To Calculate Your Unemployment Benefits

How To Calculate Your Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png) How To Calculate Your Unemployment Benefits

How To Calculate Your Unemployment Benefits

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

Applying For Unemployment Benefits During Covid 19 My Clean Slate Pa

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png) How To Calculate Your Unemployment Benefits

How To Calculate Your Unemployment Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.